American Family Insurance Group (AmFam) is a leading mutual insurance provider in the United States, known for its focus on customer service and community involvement. Here’s a quick snapshot:

- Mutual Focus: Unlike traditional insurance companies with stockholders, AmFam is a mutual company. This means policyholders are considered owners, sharing in the profits and having a say in governance.

- Diverse Coverage: AmFam offers a variety of insurance products, including auto insurance, homeowners insurance, life insurance, business insurance, and farm & ranch insurance.

- Strong Local Presence: With a network of exclusive agents throughout the country, AmFam prides itself on providing personalized service and local expertise.

What are the selection and Interview process of American Family Insurance Group?

The selection process at AmFam can vary depending on the specific role (agent, claims adjuster, underwriter, customer service representative) and location. Here’s a roadmap to navigate the AmFam hiring process:

1. Application: Submit your resume and cover letter through AmFam’s careers website.

2. Screening and Review: Recruiters assess applications for qualifications and experience outlined in the job description. They’ll focus on skills relevant to the insurance industry and the specific role (e.g., strong communication and interpersonal skills for customer service roles, analytical skills for underwriters).

3. Interview Stages (may vary):

- Phone Interview (for some roles): An initial conversation with an HR representative or hiring manager to discuss your background, motivations, and interest in the insurance industry and AmFam’s emphasis on customer service and building relationships.

- In-Person Interview(s): These may involve one or more rounds with hiring managers from the relevant department (e.g., sales, claims, underwriting, customer service) and potentially branch managers or regional leadership depending on the position. Here’s a glimpse into what you might encounter based on the role:

- Agent Roles: Be prepared for discussions about your sales experience, ability to build relationships with clients, and understanding of insurance products. You might encounter role-playing exercises to assess your sales skills and ability to explain insurance policies to potential customers. Knowledge of your local community can be a plus.

- Claims Adjuster Roles: Expect discussions about your experience handling customer inquiries and resolving issues, attention to detail, and strong communication and problem-solving skills. You might encounter scenario-based questions about handling specific claims situations.

- Underwriter Roles: These roles will likely involve discussions about your analytical skills, knowledge of insurance principles and risk assessment, and ability to evaluate insurance applications. You might encounter case studies or written assessments to test your understanding of underwriting processes.

- Customer Service Representative Roles: These roles will likely involve discussions about your customer service experience, communication and interpersonal skills, and ability to answer insurance-related questions and address customer concerns.

4. Additional Assessments (for some roles): Some positions may involve written assessments to evaluate basic insurance knowledge or aptitude for the specific role (e.g., customer service skills assessment for customer service roles).

5. Licensing (for some roles): Certain roles, like agent and adjuster, may require obtaining specific insurance licenses after employment begins. AmFam might provide resources or support for obtaining these licenses.

6. Offer and Background Check: Successful candidates will receive a job offer contingent on a background check.

Tips for Success:

- Research American Family Insurance Group thoroughly, understanding their mutual company structure, focus on customer service and local presence, and commitment to building relationships.

- Tailor your resume and cover letter to highlight relevant skills and experiences that demonstrate a strong fit for the specific role you’re applying to.

- Be prepared for discussions about the insurance industry and your passion for helping people protect their assets.

- Practice your behavioral interview skills using the STAR method (Situation, Task, Action, Result).

- Project a positive attitude, strong work ethic, and a willingness to learn (valuable in all roles!), excellent communication and interpersonal skills, and a focus on building relationships (especially for customer-facing roles).

By understanding AmFam’s selection process and showcasing your qualifications and dedication to customer service, you can increase your chances of landing an interview and a rewarding career helping people manage their insurance needs.

How many rounds of interview conducted in American Family Insurance Group?

Here’s what I can tell you about the interview process and salary for freshers at American Family Insurance Group (AmFam):

Number of Interview Rounds at AmFam:

The exact number of interview rounds can vary depending on the specific position and department, but here’s a possible range based on job board information and employee reports:

- Possible Range: Five or more rounds is typical for AmFam [1].

Breakdown of Potential Interview Stages at AmFam:

While the exact structure can vary, here’s a general idea of the interview stages you might encounter:

- Initial Application: Submit your resume, cover letter, and you might encounter a web-based assessment about your skills or suitability for the role (often for some technical positions) [1].

- Phone Interview (Possible): A recruiter might conduct a brief phone interview to discuss your experience and interest in AmFam [1].

- Multiple In-Person Interviews (Three or More): These could involve discussions with a variety of people, including [1]:

- Hiring Manager or Team Members: They will assess your qualifications, experience (if any), and fit for the specific role.

- Department Managers or Senior Leaders: You might meet with them to gain a broader understanding of the company culture and your potential contributions.

- Peers or Team Members: These discussions can provide insight into the team dynamics and work environment.

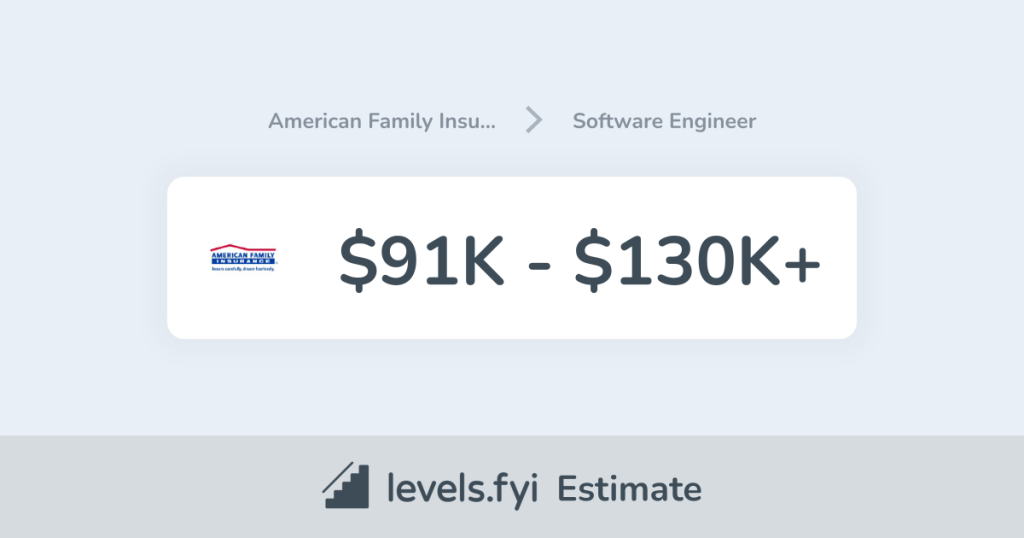

What is the salary for freshers in American Family Insurance Group?

Publicly available information on exact salaries for freshers at AmFam isn’t advertised on their careers website [2]. Here are ways to get a better idea of the range for entry-level positions:

- Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “American Family Insurance Group” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range for similar roles (e.g., underwriting trainee, claims adjuster trainee, marketing associate).

- Salary Negotiation: Be prepared to discuss salary during the offer stage, especially if you have a strong educational background in business, finance, or a related field. Research salary ranges beforehand and highlight your skills and willingness to learn to justify your desired compensation.

Here are some additional tips for landing a job at AmFam:

- Research AmFam: Learn about their focus on auto, home, life, and other insurance products [2]. Understand their commitment to community involvement and building a strong company culture [2]. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume to showcase skills and experiences relevant to the specific role you’re applying for. This could include analytical skills (for finance roles), communication skills (for customer service roles), problem-solving abilities, a strong work ethic, and a passion for helping others (especially for sales or customer service roles).

- Prepare for Behavioral and Situational Questions: Be prepared to answer both behavioral questions using the STAR method (Situation, Task, Action, Result) and situational questions about the insurance industry or AmFam’s company culture.

By following these steps, you’ll gain a better understanding of the potential interview process and salary range for freshers at AmFam. Remember, the details can vary depending on the specific position you apply for, your qualifications, and the company’s needs at the time of hiring. During the interview process, if there’s an opportunity to ask questions, inquire politely about the typical interview structure for the role you’re interested in.

Top questions Asked for freshers in American Family Insurance Group

AmFam doesn’t release an official list of top interview questions for freshers, but here’s a breakdown of what you might encounter during an interview, along with tips for finding more specific information and how to apply:

General Interview Questions for Freshers:

- Tell me about yourself and your career goals. (Tailor your answer to show interest in the insurance industry and a willingness to help people)

- Why are you interested in American Family Insurance Group specifically? (Research their focus on customer service, community involvement, and variety of insurance products)

- What are your strengths and weaknesses? (Be honest but focus on framing weaknesses as areas for development)

- Describe a time you demonstrated excellent customer service or teamwork. (Highlight relevant skills)

- Do you have any questions for us? (Prepare insightful questions to show your interest and initiative)

Possible Role-Specific Questions (Depending on the Position):

- Sales Associate/Agent: Be prepared for questions about your ability to learn about complex insurance products, communication skills, and coachability. You might also be asked about your sales goals and how you would build relationships with potential clients.

- Customer Service Representative (CSR): These roles might involve questions about your ability to handle customer inquiries patiently and efficiently. You might also be asked about your problem-solving skills and experience with technology (if applicable).

- Underwriting Associate: These roles might involve questions about your analytical skills, attention to detail, and ability to follow procedures. You might also be asked about your understanding of risk assessment principles (if applicable).

Finding More Specific Questions:

- AmFam Careers Website: Explore the careers section of AmFam’s website, particularly under “FAQs” or “Interview Tips.” They might have resources for new hires in your desired field.

- AmFam Interview Reviews: Look for interview reviews on websites like Glassdoor to get insights from past interviewees, keeping in mind that experiences may vary.

- Informational Interviews: Consider reaching out to AmFam employees on LinkedIn for informational interviews (brief conversations to learn more about the company and specific roles).

How to apply for job in American Family Insurance Group?

1. Search for Open Positions:

- Head to AmFam’s careers website: AmFam’s careers page.

2. Target Your Search:

- Utilize filters to find “Entry Level” or “Associate” positions that align with your skills and interests. You can also filter by Location, Department (e.g., Sales, Customer Service, Underwriting), or Keyword (e.g., sales associate, CSR, underwriting associate).

3. Apply Online:

- Once you discover a relevant opportunity, click “Apply Now” and follow the instructions. You’ll likely need to submit:

- Resume: Tailor your resume to highlight relevant coursework, volunteer work, or internship experiences (if applicable) in customer service, sales, or a related field. Focus on transferable skills like communication, problem-solving, ability to learn quickly, a strong work ethic, and a genuine interest in helping others. Quantify your achievements whenever possible (e.g., increased customer satisfaction by X%).

- Cover Letter (Optional, but Recommended): Craft a compelling cover letter that showcases your genuine interest in AmFam and the specific role. Tailor it to the position and highlight why you’re a strong fit (mention transferable skills if experience is limited). Express your interest in learning about insurance and providing exceptional customer service.

4. Tips:

- Highlight Transferable Skills: Even without direct experience in insurance, focus on transferable skills like communication, problem-solving, ability to learn quickly, a willingness to help others, and a strong work ethic.

- Research the Insurance Industry: Gain a basic understanding of the insurance industry and the different types of insurance products offered by AmFam.

- Demonstrate a Passion for Helping People: Express your desire to build relationships with clients and help them protect what matters most.

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024

- AES: Selection and Interview process, Questions/Answers - April 15, 2024

- Amphenol: Selection and Interview process, Questions/Answers - April 15, 2024