Ameriprise Financial is a leading diversified financial services company, empowering individuals and institutions to achieve their financial goals. Here’s a quick snapshot:

- Trusted Financial Partner: With a focus on wealth management, asset management, insurance, and annuities, Ameriprise offers a comprehensive suite of financial services to help clients navigate life’s financial journey.

- Personalized Approach: They prioritize building strong relationships with their clients, assigning dedicated financial advisors to understand individual needs and goals.

- Established Strength: Founded in 1894, Ameriprise boasts a long-standing history of financial stability and provides peace of mind to their clients.

What are the selection and Interview process of Ameriprise Financial?

The selection process at Ameriprise Financial can vary depending on the specific role (financial advisor, financial planning associate, customer service representative), location, and experience level. Here’s a general roadmap for what you might encounter:

1. Application: Submit your resume and cover letter through Ameriprise’s careers website.

2. Screening and Review: Recruiters will assess applications to identify candidates with the qualifications and experience outlined in the job description. They’ll focus on skills relevant to the financial services industry and the specific role (e.g., strong financial background for financial advisor roles, customer service experience for some roles).

3. Interview Stages (may vary):

- Phone Interview (for some roles): An initial conversation with an HR representative or hiring manager to discuss your background, motivations, and interest in the financial services industry, particularly Ameriprise’s focus on client relationships and personalized financial planning.

- In-Person Interview(s): These interviews may involve one or more rounds with hiring managers from relevant departments (e.g., wealth management, financial planning, customer service) and potentially compliance or risk management depending on the role. Here’s what you might encounter based on the role:

- Financial Advisor Roles: Be prepared for discussions about your financial background, relevant licenses (e.g., Series 7), and experience in providing financial advice. You might encounter scenario-based questions to assess your ability to evaluate client needs and recommend suitable financial products. Ameriprise may also have additional assessments to gauge your financial knowledge.

- Financial Planning Associate Roles: Expect discussions about your understanding of financial planning principles, ability to research and analyze financial products, and strong communication skills to assist financial advisors.

- Customer Service Representative Roles: You might encounter discussions about your customer service experience, ability to communicate complex financial concepts in a clear and understandable way, and empathy in dealing with client needs related to their financial products or services. Role-playing exercises might be used to assess your communication and problem-solving skills in a customer service setting.

4. Additional Assessments (for some roles): Financial advisor or financial planning associate positions might involve product knowledge assessments specific to Ameriprise’s financial products and services. Some roles may also involve assessments to evaluate basic math skills or aptitude for financial concepts.

5. Background Check and Licensing (for some roles): Successful candidates will receive a job offer contingent on a background check and obtaining necessary financial licenses (e.g., Series 7 for financial advisors).

Tips for Success:

- Research Ameriprise Financial thoroughly, understanding their financial planning philosophy, focus on client relationships, and their commitment to financial security.

- Tailor your resume and cover letter to highlight relevant skills and experiences that demonstrate a strong fit for the specific role you’re applying to.

- Be prepared for discussions about the financial services industry or relevant financial knowledge (for financial advisor or financial planning associate roles) and your passion for helping people plan for a secure financial future.

- Practice your behavioral interview skills using the STAR method (Situation, Task, Action, Result).

- Project a positive attitude, strong work ethic, and a willingness to learn (valuable in all roles!), excellent communication and interpersonal skills, and a genuine desire to build relationships and empower clients to make informed financial decisions.

By understanding Ameriprise’s selection process and showcasing your qualifications and dedication to helping people achieve their financial goals, you can increase your chances of landing an interview and a rewarding career at this leading financial services company.

How many rounds of interview conducted in Ameriprise Financial?

The interview process at Ameriprise Financial can vary depending on the specific role and location, but here’s a general idea based on information found on job boards and employee reports:

- Number of Rounds: While Ameriprise doesn’t disclose an official number, the typical range is likely two to three interview rounds [1, 2].

Breakdown of Possible Interview Stages:

- Initial Application: Submit your resume, cover letter, and you might encounter a web-based assessment about your skills or suitability for the role (often for some technical positions) [2].

- Phone Interview (Possible): A recruiter might conduct a brief phone interview to discuss your experience and interest in Ameriprise Financial [2].

- In-Person Interviews (One to Two Rounds): These could involve discussions with [2]:

- Hiring Manager or Team Members from the department you’re applying for: They will assess your qualifications, experience (if any), and fit for the specific role (e.g., analytical skills for finance roles, communication skills for customer service roles).

- Senior Managers or Department Heads (Possible for some roles): You might meet with senior managers or department heads for a more in-depth discussion about the role, responsibilities, and Ameriprise’s culture (more likely for experienced hires or higher-level positions).

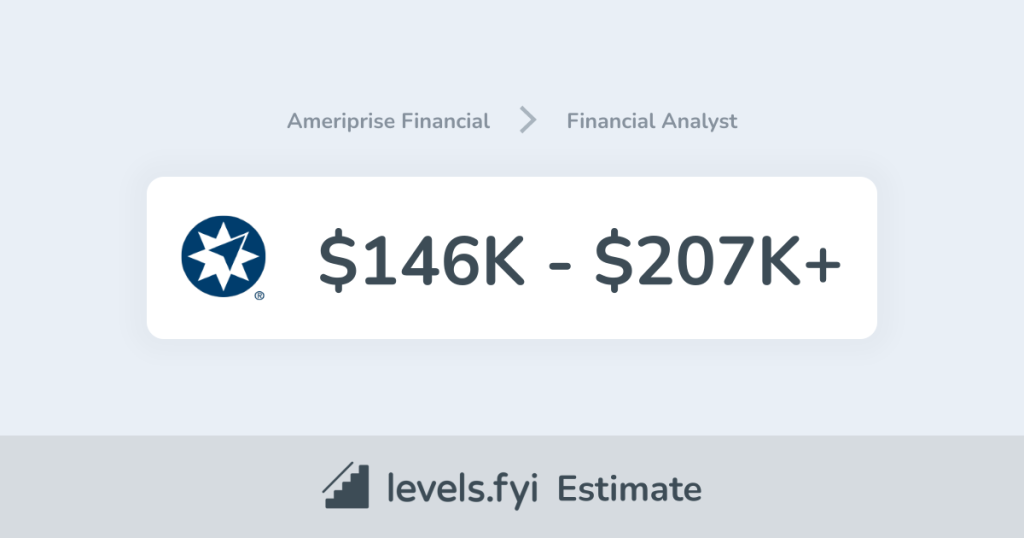

What is the salary for freshers in Ameriprise Financial?

Publicly available information on exact salaries for freshers at Ameriprise Financial isn’t advertised on their careers website [3]. Here are ways to get a better idea of the range for entry-level positions:

- Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “Ameriprise Financial” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range for similar roles (e.g., customer service associate, financial analyst trainee, data analyst).

- Salary Negotiation: Be prepared to discuss salary during the offer stage, especially if you have relevant experience or a strong educational background in business, finance, or a related field. Research salary ranges beforehand and highlight your skills and willingness to learn to justify your desired compensation.

Tips for Landing a Job at Ameriprise Financial:

- Research Ameriprise Financial: Learn about their areas of expertise in financial planning, wealth management, and retirement services [3]. Understand their focus on putting clients first, fostering a culture of inclusion, and financial wellness [3]. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume to showcase skills and experiences relevant to the specific role you’re applying for. This could include technical skills (for IT or finance positions), communication skills, customer service skills, a strong work ethic, and a passion for the financial services industry (if applicable).

- Prepare for Behavioral and Technical Questions: Be prepared to answer both behavioral questions using the STAR method (Situation, Task, Action, Result) to showcase your problem-solving skills and achievements, and technical questions relevant to the role (if applicable).

By following these steps, you’ll gain a better understanding of the potential interview process and salary range for freshers at Ameriprise Financial. Remember, the specific details can vary depending on the position you apply for, your qualifications, and the company’s needs at the time of hiring. During the interview process, if there’s an opportunity to ask questions, you can inquire politely about the typical interview structure for the role you’re interested in.

Top questions Asked for freshers in Ameriprise Financial

Ameriprise Financial doesn’t release an official list of top interview questions for freshers, but here’s a breakdown of what you might encounter during an interview, along with tips for finding more specific information:

General Interview Questions for Freshers:

- Tell me about yourself and your career goals in financial services (or a related field). (Tailor your answer to show interest in Ameriprise’s focus on wealth management and financial planning)

- Why are you interested in Ameriprise Financial specifically? (Research their client-centric approach, advisor network, and commitment to financial literacy)

- What are your strengths and weaknesses? (Be honest but focus on framing weaknesses as areas for development)

- Describe a time you demonstrated excellent customer service. (Highlight your interpersonal and communication skills)

- Do you have any questions for us? (Prepare insightful questions to show your interest and initiative)

Possible Role-Specific Questions (Depending on the Position):

- Client Service Associate: Be prepared for questions about your ability to learn complex financial concepts, attention to detail, and strong communication and interpersonal skills. You might also be asked about your willingness to build rapport with clients.

- Financial Advisor Associate: These roles might involve questions about your analytical skills, understanding of financial products, and ability to explain financial concepts to clients in a clear and concise manner. Research skills and a desire to learn about the financial markets are also important.

Tips for Finding More Specific Questions:

- Ameriprise Financial Careers Website: Explore the careers section of Ameriprise’s website, particularly under “FAQs” or “Interview Tips.” They might have resources for new hires in your desired field.

- Ameriprise Financial Interview Reviews: Look for interview reviews on websites like Glassdoor to get insights from past interviewees, keeping in mind that experiences may vary.

- Informational Interviews: Consider reaching out to Ameriprise Financial employees on LinkedIn for informational interviews (brief conversations to learn more about the company and specific roles).

How to apply for job in Ameriprise Financial?

1. Search for Open Positions:

- Head to Ameriprise Financial’s careers website: Ameriprise Financial’s careers page.

2. Target Your Search:

- Utilize filters to find “Entry Level” or “Associate” positions that align with your skills and interests. You can also filter by Location, Department (e.g., Client Services, Financial Advisor Training), or Keyword (e.g., client service associate, financial advisor associate).

3. Apply Online:

- Once you discover a relevant opportunity, click “Apply Now” and follow the instructions. You’ll likely need to submit:

- Resume: Tailor your resume to highlight relevant coursework, volunteer work, or internship experiences (if applicable) in finance, customer service, or a related field. Focus on transferable skills like communication, problem-solving, ability to learn quickly, a strong work ethic, and an interest in helping others. Quantify your achievements whenever possible (e.g., improved customer satisfaction by X%).

- Cover Letter (Optional, but Recommended): Craft a compelling cover letter that showcases your genuine interest in Ameriprise Financial and the specific role. Tailor it to the position and highlight why you’re a strong fit (mention transferable skills if experience is limited). Express your interest in financial services and helping people achieve their financial goals.

4. Tips:

- Highlight Transferable Skills: Even without direct experience in financial services, focus on transferable skills like communication, teamwork, problem-solving, a willingness to learn, and a strong work ethic.

- Demonstrate Your Organization Skills: Financial services can be detail-oriented, so highlight any experiences that demonstrate your organization and time management skills.

- Research Financial Planning Basics: Gain a basic understanding of financial planning concepts like budgeting, retirement planning, and investment basics. This will show your interest in the industry.

By combining this information with research on Ameriprise Financial and the specific role, you can be well-prepared to answer a variety of interview questions and increase your chances of landing an entry-level position in the exciting world of financial services!

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024

- AES: Selection and Interview process, Questions/Answers - April 15, 2024

- Amphenol: Selection and Interview process, Questions/Answers - April 15, 2024