Capital One Financial Corporation is a leading American financial institution known for its innovative approach to banking. Here’s a quick overview:

- Tech-Driven Banking: Capital One leverages technology to provide a user-friendly and accessible banking experience for its customers.

- Diverse Financial Services: They offer a wide range of financial products and services, including credit cards, auto loans, mortgages, savings accounts, and online banking platforms.

- Growth Through Innovation: Capital One is constantly developing new products and services to meet the evolving needs of their customers.

Career Opportunities:

A career at Capital One offers exciting opportunities in various financial service areas:

- Credit Card Services: Specialists managing credit card applications, analyzing customer data, and developing new credit card products.

- Consumer Banking: Personal bankers, loan officers, and customer service representatives assisting customers with checking and savings accounts, loans, and other banking needs.

- Technology and Analytics: Software engineers, data analysts, and IT professionals developing and maintaining Capital One’s technology infrastructure and data-driven solutions.

- Marketing and Sales: Marketing specialists promoting Capital One’s products and services, and sales representatives acquiring new customers.

- Risk Management and Compliance: Ensuring Capital One adheres to regulations and manages financial risks effectively.

What are the selection and Interview process of Capital One Financial?

The selection process at Capital One can vary depending on the specific role, department, and location. Here’s a general overview of the potential steps:

1. Application: Submit your resume and cover letter through Capital One’s careers website [1]. Tailor your application materials to highlight relevant skills and experiences for the specific position you’re applying for.

2. Online Assessments (likely for most roles): You’ll likely encounter online assessments to gauge your abilities in areas like problem-solving, basic math skills, or situational judgment tests (depending on the role).

3. Video Interview (possible for some roles): An initial pre-recorded video interview where you answer pre-determined questions might occur.

4. Phone Interview (possible for some roles): An initial conversation with a recruiter to discuss your qualifications and suitability for the role might occur.

5. In-Person Interview(s): This stage can involve one or more in-person interviews with hiring managers, team members from the department you’re applying to, or specialists relevant to the role (e.g., credit card specialists for credit card roles). Be prepared for a mix of questions about:

* **Skills and Experience:** Showcase how your skills and experience align with the job requirements (e.g., customer service experience for client-facing roles, analytical skills for data-driven roles, technical skills for IT roles).

* **Problem-Solving Skills:** Demonstrate your ability to analyze situations and propose solutions relevant to the financial services industry.

* **Customer Focus:** Highlighting your understanding of customer needs and your ability to provide exceptional service is important (especially for client-facing roles).

* **Data-Driven Approach (for some roles):** An ability to leverage data for decision-making might be sought after (especially for marketing or analytical roles).

* **Innovation and Adaptability:** Capital One values a growth mindset and the ability to adapt to new technologies and trends in the financial services industry.

6. Background Check and Drug Test: These are standard procedures for most positions at Capital One.

Tips to Shine During the Process:

- Research Capital One: Demonstrate your knowledge of their innovative approach to banking, their focus on technology, and the variety of financial products and services they offer.

- Highlight Your Skills and Achievements: Tailor your resume and interview responses to showcase your relevant skills and achievements, emphasizing customer service experience (for client-facing roles), analytical skills (for data-driven roles), technical skills (for IT roles), or prior success in your field.

- Client Focus: Express your passion for helping customers achieve their financial goals and your ability to build strong client relationships.

- Data Awareness (for some roles): If the role involves data analysis or marketing, showcase your understanding of data-driven approaches in the financial services industry.

- Embrace Innovation: Highlight your willingness to learn new technologies and adapt to a fast-paced and evolving work environment.

How many rounds of interview conducted in Capital One Financial?

The number of interview rounds at Capital One Financial can vary depending on the specific role and department. However, here’s a general idea:

Number of Interview Rounds:

- Typically: Expect 3-4 rounds of interviews for most positions, including freshers.

- Possible Variations:

- Some roles, especially entry-level or less technical ones, might have a shorter interview process (2-3 rounds).

- More senior roles or those requiring a high level of technical expertise might involve additional rounds (4-5+).

Here are some ways to get more specific information about the interview process for a particular role:

- Capital One Careers Website: The Capital One careers website might have information about the typical interview process for different roles.

- Search Online: Look for interview experiences shared on sites like Glassdoor or Indeed. Search for “Capital One interview experience” or “Capital One [position name] interview” to see if past candidates have mentioned the number of rounds in their experiences.

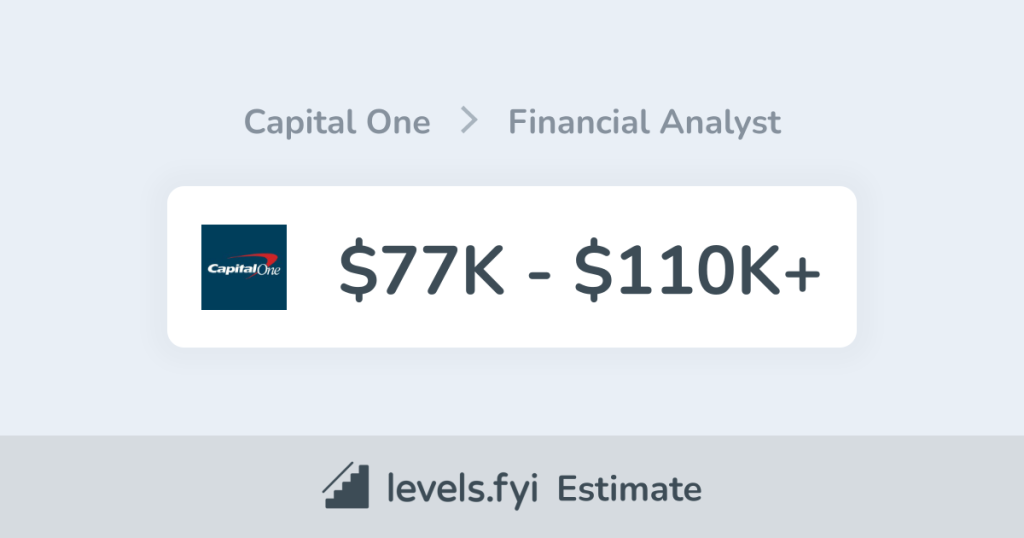

What is the salary for freshers in Capital One Financial?

Similar to the interview process, exact salary information for freshers at Capital One can vary depending on the specific role, location, and your qualifications. Here are some ways to get a better idea of the salary range:

- Levels.fyi: This website allows you to search for salary information based on company, location, and job title. It can give you a general range for entry-level positions at Capital One.

- Glassdoor: Glassdoor sometimes has salary information submitted by anonymous employees. Search for “Capital One [position name] salary” to see if any data is available.

- Salary Comparison Websites: Websites like Indeed or Salary.com can provide salary information based on job title and location. Search for “Entry Level [Job Title] Salary in [Your Location]” to get a general sense of the range.

Tips for Freshers at Capital One:

- Highlight relevant skills and experiences: When applying, tailor your resume and cover letter to the specific position. Showcase relevant coursework, projects (if any), and any skills that demonstrate your ability to learn and thrive in a fast-paced environment.

- Practice for case interviews: Capital One is known for using case interviews during their hiring process. Research common case interview questions and practice your analytical thinking and problem-solving skills.

- Research Capital One’s culture: Familiarize yourself with Capital One’s company culture and mission. Be prepared to discuss your interest in their work environment and how your skills can contribute to their success.

By following these tips, you can increase your chances of landing a job at Capital One and potentially negotiating a competitive salary offer.

Top questions Asked for freshers in Capital One Financial

Here are some of the common questions freshers typically ask about Capital One Financial:

- Company Culture and Work Environment:

- What is the work environment like for young professionals at Capital One?

- Is Capital One known for a strong work-life balance, or is it more fast-paced?

- Does Capital One offer opportunities to learn and grow through mentorship programs or training initiatives?

- Role-Specific Inquiries:

- What are the expectations for a fresher in the (mention your specific role) position?

- What are the biggest challenges faced by new hires in this role, and how does Capital One support overcoming them?

- What are the career paths and advancement opportunities within Capital One for someone in (mention your field)?

- Benefits and Compensation:

- Does Capital One offer competitive salaries and benefits packages for freshers?

- Are there any financial aid programs or tuition reimbursement options for continuing education?

How to apply for job in Capital One Financial?

There are a couple of ways to apply for a job at Capital One Financial:

- Capital One Careers Website: Capital One has a careers website where you can search for open positions and submit your application online. Look for “Careers” on the Capital One website.

- LinkedIn: Capital One also posts job openings on LinkedIn. You can follow Capital One on LinkedIn and search for open positions that match your qualifications.

Some additional tips for applying for a job at Capital One:

- Tailor your resume and cover letter to the specific position you are applying for. Highlight the skills and experiences that are most relevant to the job requirements.

- Research Capital One and be prepared to talk about why you are interested in working for the company. What aspects of their culture or mission resonate with you?

- Be prepared to answer common interview questions and practice your interview skills. Some resources for interview prep include online resources or attending career fairs/workshops offered by your university.

By following these tips, you can increase your chances of landing your dream job at Capital One Financial.

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024

- AES: Selection and Interview process, Questions/Answers - April 15, 2024

- Amphenol: Selection and Interview process, Questions/Answers - April 15, 2024