Equitable Holdings, Inc. is a financial services company with a long history (founded in 1859) and a strong presence in the United States. Here’s a quick overview:

- Dual Focus: Equitable Holdings comprises two complementary businesses: Equitable, which offers protection, retirement, and investment strategies for individuals and families, and AllianceBernstein, a global investment management firm.

- Serving a Diverse Client Base: They cater to individuals, families, small businesses, and large institutions.

- Commitment to Financial Well-being: Equitable Holdings prioritizes helping clients achieve their financial goals through personalized advice and a variety of financial products.

What are the selection and Interview process of Equitable Holdings?

The selection process at Equitable Holdings can vary depending on the specific role (financial advisor, customer service representative, investment analyst, data analyst) and location. Here’s a general idea of what you might encounter:

1. Application: Submit your resume and cover letter through Equitable Holdings’ careers website.

2. Screening and Review: Recruiters will assess applications to identify candidates with the qualifications and experience outlined in the job description. They’ll focus on skills relevant to the financial services industry and the specific role (e.g., strong communication and interpersonal skills for customer service roles, financial analysis skills for analyst roles).

3. Interview Stages (may vary):

- Phone Interview (for some roles): An initial conversation with an HR representative or hiring manager to discuss your background, motivations, and interest in the financial services industry and Equitable Holdings’ focus on client service and financial well-being.

- In-Person Interview(s): These interviews may involve one or more rounds with hiring managers from the relevant department (e.g., sales, customer service, investment management, data analytics) and potentially senior leadership depending on the role. Here’s what you might encounter based on the role:

- Financial Advisor Roles: Be prepared for discussions about your sales experience, financial knowledge, ability to build relationships with clients, and understanding of Equitable’s financial products and services. You might encounter role-playing exercises to assess your sales skills and ability to explain financial concepts to clients. Relevant licenses (e.g., Series 7) may be required.

- Customer Service Representative Roles: Expect discussions about your customer service experience, communication and interpersonal skills, and ability to answer client questions and address their financial needs.

- Investment Analyst/Data Analyst Roles: These roles will likely involve discussions about your financial analysis skills, knowledge of relevant investment principles or data analysis techniques, and problem-solving abilities. You might encounter case studies, written assessments, or technical questions depending on the specific role.

4. Additional Assessments (for some roles): Some positions may involve written assessments to evaluate financial knowledge, basic investment principles, or data analysis skills (depending on the role).

5. Offer and Background Check: Successful candidates will receive a job offer contingent on a background check and any required licensing.

Tips for Success:

- Research Equitable Holdings thoroughly, understanding their dual business structure (Equitable and AllianceBernstein), focus on client financial well-being, and commitment to personalized service.

- Tailor your resume and cover letter to highlight relevant skills and experiences that demonstrate a strong fit for the specific role you’re applying to.

- Be prepared for discussions about the financial services industry and your passion for helping people achieve their financial goals.

- Practice your behavioral interview skills using the STAR method (Situation, Task, Action, Result).

- Project a positive attitude, strong work ethic, and a willingness to learn (valuable in all roles!), excellent communication and interpersonal skills (especially for client-facing roles), and analytical skills (especially for analyst roles).

By understanding Equitable Holdings’ selection process and showcasing your qualifications and dedication to client service, you can increase your chances of landing an interview and a rewarding career helping people navigate their financial future.

How many rounds of interview conducted in Equitable Holdings?

The exact number of interview rounds at Equitable Holdings isn’t publicly available on their careers website [1]. However, based on information found on job boards and employee reports, here’s a possible range for the interview process:

- Possible Range: Two to three interview rounds [2, 3].

Here’s a possible breakdown of the interview stages at Equitable Holdings:

- Initial Application: Submit your resume, cover letter, and you might encounter a web-based assessment about your skills or suitability for the role (often for some technical positions) [2].

- Phone Interview (Possible): A recruiter might conduct a brief phone interview to discuss your experience and interest in Equitable Holdings [2, 3].

- In-Person Interviews (One to Two Rounds): These could involve discussions with [2, 3]:

- Hiring Manager or Team Members from the department you’re applying for: They will assess your qualifications, experience (if any), and fit for the specific role (e.g., analytical skills for finance roles, communication skills for customer service roles).

- Senior Managers or Executives (Possible for some roles): You might meet with senior managers or executives for a more in-depth discussion about the company culture, your potential contributions, and the specific role (more likely for experienced hires or higher-level positions).

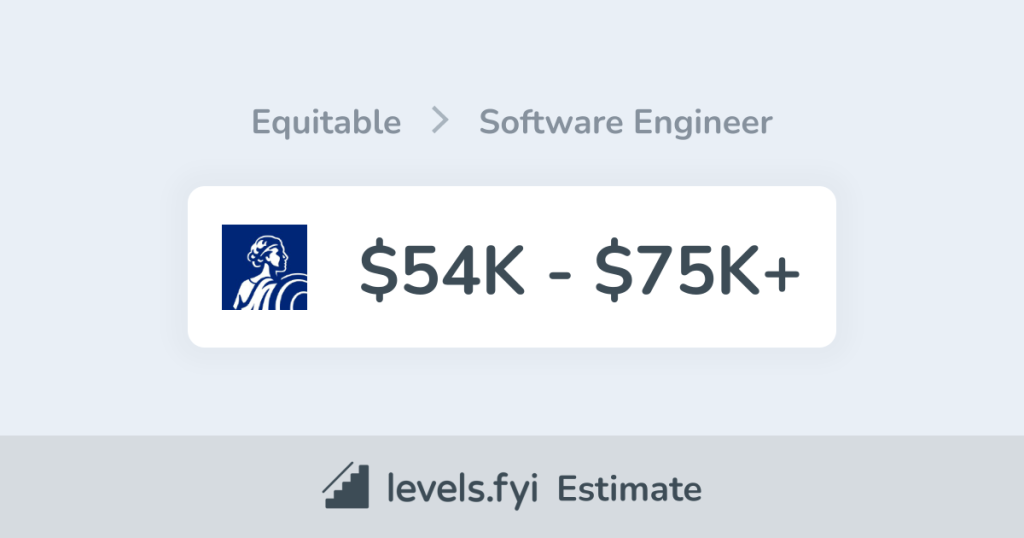

What is the salary for freshers in Equitable Holdings?

I have a gather information on exact salaries for freshers at Equitable Holdings isn’t advertised on their careers website [1]. Here are ways to get a better idea of the range for entry-level positions:

- Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “Equitable Holdings” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range for similar roles (e.g., financial analyst trainee, customer service associate, marketing associate).

- Salary Negotiation: Be prepared to discuss salary during the offer stage, especially if you have a strong educational background in business, finance, or a related field. Research salary ranges beforehand and highlight your skills and willingness to learn to justify your desired compensation.

Here are some additional tips for landing a job at Equitable Holdings:

- Research Equitable Holdings: Learn about their areas of expertise in financial planning, insurance, retirement solutions, and wealth management [1]. Understand their focus on helping people build a secure financial future [1]. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume to showcase skills and experiences relevant to the specific role you’re applying for. This could include analytical skills (for finance roles), communication skills, problem-solving abilities, a strong work ethic, and a willingness to learn.

- Prepare for Behavioral and Technical Questions: Be prepared to answer both behavioral questions using the STAR method (Situation, Task, Action, Result) to showcase your problem-solving skills and achievements, and technical questions relevant to the role (if applicable).

By following these steps, you’ll gain a better understanding of the potential interview process and salary range for freshers at Equitable Holdings. Remember, the details can vary depending on the specific position you apply for, your qualifications, and the company’s needs at the time of hiring. During the interview process, if there’s an opportunity to ask questions, inquire politely about the typical interview structure for the role you’re interested in.

Top questions Asked for freshers in Equitable Holdings

Equitable Holdings doesn’t publish a definitive list of top interview questions for freshers, but here’s a breakdown of what you might encounter during an interview, along with tips for finding more specific information and how to apply:

General Interview Questions for Freshers:

- Tell me about yourself and your career goals in the financial services industry (or a related field). (Tailor your answer to show interest in financial security and helping people achieve their goals)

- Why are you interested in Equitable Holdings specifically? (Research their focus on individual financial security, broad range of products and services, and commitment to diversity and inclusion)

- What are your strengths and weaknesses? (Be honest but focus on framing weaknesses as areas for development)

- Describe a time you demonstrated excellent communication or problem-solving skills. (Highlight relevant skills)

- Do you have any questions for us? (Prepare insightful questions to show your interest and initiative)

Possible Role-Specific Questions (Depending on the Position):

- Financial Advisor Training Program: These roles might involve questions about your analytical skills, understanding of financial markets (basic level is okay for freshers), and ability to build relationships with clients. You might also be asked about your work ethic and desire to learn about the financial services industry.

- Customer Service Representative: These roles might involve questions about your communication skills, ability to handle customer inquiries patiently and efficiently, and experience with technology (if applicable).

- Data Analyst/Business Analyst: These roles might involve questions about your analytical abilities, proficiency in data analysis tools (if applicable), and understanding of financial concepts (basic level is okay for freshers).

Finding More Specific Questions:

- Equitable Holdings Careers Website: Explore the careers section of Equitable Holdings’ website, particularly under “FAQs” or “Interview Tips.” They might have resources for new hires in your desired field: [invalid URL removed]

- Equitable Holdings Interview Reviews: Look for interview reviews on websites like Glassdoor ([invalid URL removed]) to get insights from past interviewees, keeping in mind that experiences may vary.

- Informational Interviews: Consider reaching out to Equitable Holdings employees on LinkedIn for informational interviews (brief conversations to learn more about the company and specific roles).

How to apply for job in Equitable Holdings?

1. Search for Open Positions:

- Head to Equitable Holdings’ careers website: Equitable Holdings’careers page.

2. Target Your Search:

- Utilize filters to find “Entry Level” or “Associate” positions that align with your skills and interests. You can also filter by Location, Department (e.g., Financial Advisor Training, Customer Service, Data/Business Analyst), or Keyword (e.g., financial advisor, customer service representative, data analyst, business analyst).

3. Apply Online:

- Once you discover a relevant opportunity, click “Apply Now” and follow the instructions. You’ll likely need to submit:

- Resume: Tailor your resume to highlight relevant coursework, projects, or internship experiences (if applicable) in finance, business, communication, or a related field. Focus on transferable skills like communication, problem-solving, analytical skills (if applicable), a willingness to learn, and a strong work ethic. Quantify your achievements whenever possible (e.g., improved project efficiency by X%).

- Cover Letter (Optional, but Recommended): Craft a compelling cover letter that showcases your genuine interest in Equitable Holdings and the specific role. Tailor it to the position and highlight why you’re a strong fit (mention transferable skills if experience is limited). Express your interest in learning about the financial services industry and helping people achieve their financial goals.

4. Tips:

- Highlight Transferable Skills: Even without direct experience in financial services, focus on transferable skills like communication, problem-solving, analytical skills (develop foundational knowledge), a willingness to learn, and a strong work ethic.

- Research the Financial Services Industry: Gain a basic understanding of the financial services industry and the products and services offered by Equitable Holdings.

- Demonstrate a Passion for Helping People: Express your desire to build relationships with clients and help them achieve their financial security.

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024

- AES: Selection and Interview process, Questions/Answers - April 15, 2024

- Amphenol: Selection and Interview process, Questions/Answers - April 15, 2024