Fannie Mae is a government-sponsored enterprise (GSE) that plays a vital role in the US housing market by providing liquidity for the mortgage industry. It does this by purchasing mortgages from lenders, and through these activities, aims to ensure affordability and availability of mortgage financing for various borrowers.

What are the selection and Interview process of Fannie Mae?

Selection and Interview Process at Fannie Mae

The selection process at Fannie Mae generally follows these stages:

1. Application: Submit your resume and cover letter online through their careers website, highlighting relevant skills and experiences.

2. Phone Screening: If your application aligns with the role’s requirements, a recruiter might contact you for a phone call to discuss your background, qualifications, and interest in the position.

3. Behavioral Interviews: Successful candidates typically proceed to one or two behavioral interviews with hiring managers or team members. These in-depth discussions focus on your past experiences and use the STAR method (Situation, Task, Action, Result) to assess problem-solving skills, decision-making abilities, and alignment with company values.

4. Reference Checks and Background Screening: If you progress through the interview rounds, Fannie Mae might conduct reference checks and background screening to verify your qualifications and suitability for the position.

Tips:

- Research Fannie Mae’s mission and focus on improving housing access to demonstrate understanding and potential fit with their vision.

- Prepare specific examples using the STAR method while answering behavioral questions, highlighting your achievements and problem-solving skills.

- Review Fannie Mae’s career resources on their website for interview tips and insights into the company culture.

Notes:

- Dress professionally for the interview and be on time.

- Ask thoughtful questions about the role, the team, and Fannie Mae’s mission to demonstrate your genuine interest.

- Follow up with a thank-you email to express your gratitude for the opportunity and reiterate your interest in the position.

Remember, being well-prepared, showcasing your relevant skills and experience, and expressing enthusiasm for Fannie Mae’s mission can significantly improve your chances of success in the selection process.

How many rounds of interview conducted in Fannie Mae?

The number of interview rounds at Fannie Mae can vary depending on the specific position you are applying for, but it typically involves two to three rounds. Here’s a breakdown of the possible rounds:

1. Round 1: Online Assessments and/or Phone/Video Screening:

- This initial stage usually involves online assessments to evaluate your basic skills and knowledge relevant to the role. You might also have a phone or video interview with a recruiter to assess your qualifications and interest.

2. Round 2: In-Person Interview:

- Shortlisted candidates are typically invited for an in-person interview at a Fannie Mae location or district office. This interview might involve:

- Individual Interview: A one-on-one conversation with the hiring manager to delve deeper into your experience, skills, and suitability for the role.

- Panel Interview: In some cases, you might encounter a panel interview with the hiring manager and another store manager or team member.

Additional Rounds (Less Common):

- Second In-Person Interview: Rarely, a second in-person interview might occur, especially for higher-level positions or those requiring specialized skills.

- Group Interview: In some instances, Fannie Mae might utilize group interviews for specific roles to assess your interaction and collaboration skills within a team setting.

Factors Affecting Interview Rounds:

It’s important to note that several factors can influence the number of interview rounds you might experience:

- Seniority of the position: Higher-level positions might involve additional rounds of interviews for a more thorough evaluation of candidates.

- Complexity of the role: Positions requiring specialized skills or extensive experience might involve more rounds of interviews to assess your qualifications thoroughly.

- Availability of interviewers: The availability of interviewers at different stages can also affect the number of interview rounds.

Here’s a crucial tip:

Always consult the specific job posting and company website for the most accurate information about the number of interview rounds expected for the position you are interested in. They might explicitly mention the interview process stages or mention contacting the recruiter for further details.

What is the salary for freshers in Fannie Mae?

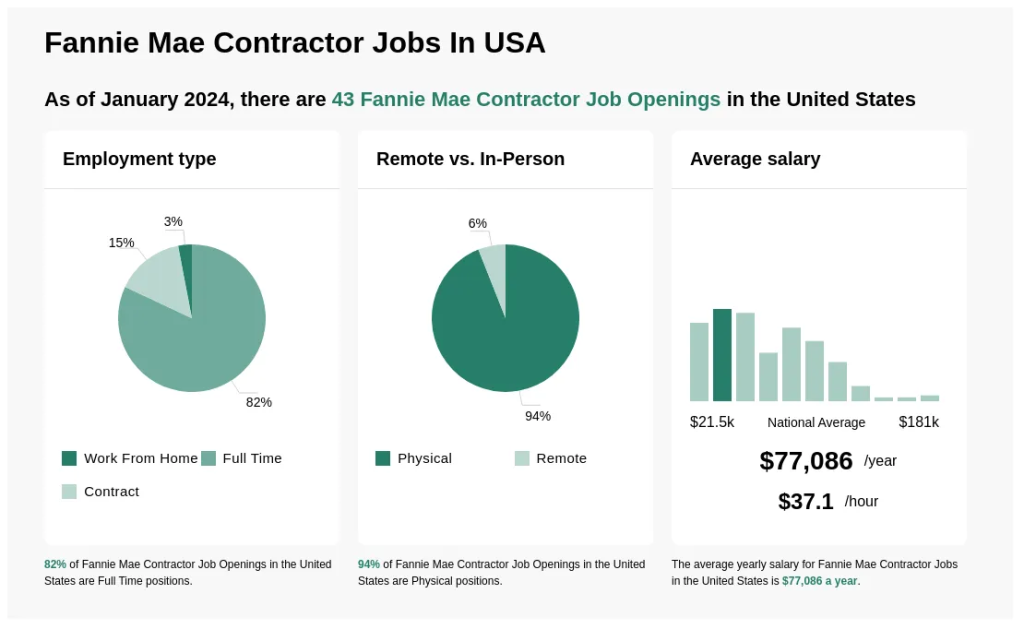

While precise salary figures for freshers at Fannie Mae are difficult to obtain due to privacy and confidentiality reasons, several sources can help you estimate the starting salary range:

1. Salary Comparison Websites:

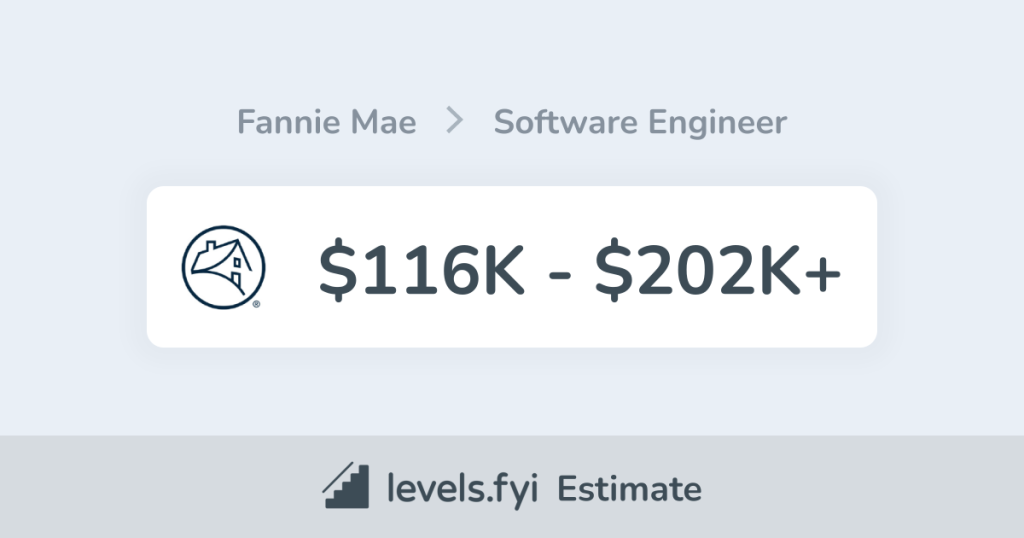

Websites like levels.fyi and salary.com provide estimations based on user-submitted data. However, accuracy may vary. Here are the retrieved estimations (as of March 1, 2024):

- Levels.fyi: Associate (Entry Level) – $116,000 base salary

- Salary.com: Entry-level positions – $60,000 to $80,000

2. Job Postings:

Check job postings specifically on the Fannie Mae careers website for salary ranges mentioned in the job descriptions. If not explicitly stated, consider contacting the company for clarification.

3. News Articles and Reports:

Financial news articles or industry reports might occasionally mention salary ranges for entry-level positions at Fannie Mae. However, such information might not be readily available or entirely up-to-date.

4. Considering the Factors:

Remember, several factors can influence your starting salary at Fannie Mae, even within the “freshers” category:

- Specific role: Different roles, even at the entry level, can have varying pay ranges depending on their responsibilities and complexity.

- Location: Cost of living in your specific location can significantly impact your salary offer.

- Education and experience: While freshers generally have a base rate, relevant experience, skills, or certifications might contribute to a higher starting salary.

- Negotiation: After receiving an offer, negotiation is an option, so be prepared to present your value proposition to potentially increase your starting salary.

In conclusion:

While a specific salary figure for freshers at Fannie Mae is challenging to pinpoint, you can expect a potential range of $60,000 to $116,000 annually based on available sources and considering the factors mentioned above. Utilize the various resources and prepare for negotiation to better understand and potentially influence your starting salary when applying for a position at Fannie Mae.

Top questions Asked for freshers in Fannie Mae

Here are some common questions you might encounter during an interview for a fresh graduate position at Fannie Mae:

General Experience and Background:

- Tell me about yourself and your interest in this position at Fannie Mae.

- Walk me through your educational background and how it prepared you for a career in [relevant field, e.g., finance, economics, data analysis].

- Do you have any relevant work experience, even if it’s not directly related to this role? (e.g., internships, volunteer work, projects showcasing relevant skills)

- What are your career goals, and how does this position fit into your plans?

Skills and Abilities:

- Describe your skills in [relevant skill] and how you would apply them in this role. (e.g., communication, problem-solving, analytical skills, attention to detail, teamwork)

- Are you familiar with [relevant software or technology] used at Fannie Mae? (e.g., Microsoft Office Suite, data analysis software like Python or R)

- How do you stay up-to-date with current trends and developments in the [relevant field]? (e.g., financial markets, housing industry)

- Tell me about a time you faced a challenge and how you overcame it. (This assesses problem-solving and adaptability)

Company and Role-Specific:

- What do you know about Fannie Mae and its mission to support affordable housing?

- Why are you interested in working for Fannie Mae specifically?

- What specifically excites you about this particular role?

- Do you have any questions for me about the position or Fannie Mae?

Additionally, depending on the specific department or role, freshers might be asked questions related to:

- Understanding of basic financial concepts and mortgage processes.

- Ability to work with and analyze large datasets.

- Strong commitment to ethical and responsible business practices.

- Interest in the housing industry and its impact on communities.

Here are some bonus tips:

- Be prepared to answer behavioral questions that start with “Tell me about a time…” These questions assess your skills and past experiences in a specific context. Use the STAR method (Situation, Task, Action, Result) to structure your answers effectively.

- Research common case interview questions relevant to the finance or mortgage industry. These questions might involve analyzing a hypothetical business scenario and proposing solutions.

- Practice your communication skills and ensure clear, concise, and professional responses throughout the interview process.

- Show your enthusiasm and genuine interest in Fannie Mae’s mission and the specific role you are applying for.

By preparing for these commonly asked questions, demonstrating your skills and qualifications, and expressing your interest in the role and Fannie Mae, you can increase your chances of success in the interview process.

How to apply for job in Fannie Mae?

Here’s how to apply for a job at Fannie Mae:

1. Explore Career Opportunities:

- Visit the Fannie Mae Careers website.

- You can search for positions by keyword, location, department, job category (e.g., Finance, Technology, Risk Management), or even job level (e.g., Entry-Level, Mid-Level, Senior).

- Carefully read the job descriptions to understand required qualifications, responsibilities, and benefits offered for each position.

2. Identify a Suitable Role:

- Pay close attention to the “Minimum Qualifications” and “Preferred Qualifications” sections of the job description.

- Ensure you meet the minimum qualifications before applying and showcase relevant skills and experiences that align with the preferred qualifications.

3. Prepare Application Materials:

- Resume: Update your resume to highlight relevant skills and experiences for the specific role you are applying to.

- Use keywords mentioned in the job description and tailor your resume to showcase how your qualifications meet the position’s requirements.

- Cover Letter: Craft a compelling cover letter expressing your interest in the specific position and company. Briefly explain why you are a good fit for the role and highlight your key strengths and accomplishments relevant to the job.

4. Submit Your Application:

- Once you have prepared your resume and cover letter, submit your application through the online portal on the Fannie Mae Careers website.

- Follow the specific instructions provided for each job listing and ensure you complete all required sections of the application form.

- You might have the option to upload a cover letter or resume as separate documents, depending on the specific job posting.

5. Additional Information (Optional):

- Some positions might have additional application requirements, like online assessments, video interviews, or references. Ensure you follow all instructions and complete any required steps before the deadline.

Tips:

- Research Fannie Mae: Familiarize yourself with the company’s mission, values, and current initiatives. Demonstrating your knowledge and alignment with the company can make a positive impression during the interview process.

- Highlight your transferable skills: If you don’t have specific industry experience, focus on transferable skills like analytical thinking, problem-solving, communication, and teamwork, which are valuable in various roles at Fannie Mae.

- Network with Professionals: If possible, try connecting with professionals working at Fannie Mae through LinkedIn or professional networking events. Gaining insights and advice from existing employees can be incredibly helpful in navigating the application and interview process.

By following these steps and demonstrating your qualifications and interest in Fannie Mae, you can increase your chances of securing an interview and potentially landing a rewarding opportunity at Fannie Mae.

- Buy TikTok Followers: In the Sense of Advertising - May 25, 2024

- Understanding the Key Principles of PhoneTrackers - May 23, 2024

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024