In the competitive landscape of the FinTech industry, the emergence of ChatGPT has been a game-changer, quickly becoming a topic of strategic importance. As a pioneering force in generative AI for FinTech, ChatGPT serves both as an advanced training model and as a cutting-edge tool, leveraging Generative Adversarial Networks (GANs) to produce outcomes that accurately reflect real-world scenarios based on its expansive training data.

Generative AI, with its capability to create, simulate, and predict data-driven outcomes, is fast becoming the cornerstone of forward-thinking strategies in the financial technology space. This approach enables FinTech companies to not only automate routine tasks but also to uncover insights and strategies that were previously beyond reach, setting the stage for unprecedented growth and transformation.

As a trailblazer in this technological revolution, Geniusee has been at the forefront of harnessing the power of generative AI to drive innovation within the FinTech sector. Recognizing the potential to transform traditional financial services, our company has dedicated itself to developing AI-driven solutions that cater to the specific needs of our clients.

This article aims to equip FinTech leaders with the knowledge needed to strategically integrate generative AI technologies into their operations to increase efficiency and competitive advantage. Read it to get a comprehensive overview of how to use generative AI in your business development.

Generative AI for Preventing Fraud

According to a report by Allied Market Research, the market for fraud detection and prevention stood at $29.5 billion in 2022, with projections indicating a rise to over $252 billion by 2032. In this burgeoning sector, generative AI is poised to become a pivotal technology, especially within the FinTech industry.

The evolution of AI technologies has enabled the development of models capable of sifting through vast volumes of transactional data to identify irregular patterns indicative of fraud.

Moreover, generative AI technologies are adept at recognizing atypical user behaviors and suspicious data trends, effectively averting fraudulent activities before they occur.

One of the strengths of generative AI is its ability to learn and evolve by assimilating new data and patterns, which places it at the forefront of combating emerging threats and minimizing financial damages. Although the updating of datasets for generative AI technologies can be performed manually by companies to accelerate the learning process, its inherent adaptability is a significant advantage.

Case Study: PayPal’s Application of AI in Fraud Prevention

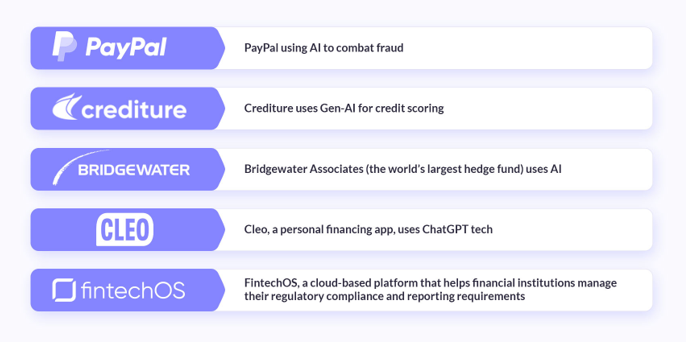

PayPal exemplifies the use of generative AI for enhancing fraud detection mechanisms. By analyzing behavioral patterns and discrepancies in user actions, PayPal is at the forefront of identifying and mitigating fraudulent activities.

The company integrates data on device specifics, session behaviors, and information from third-party sources to construct comprehensive profiles of users and their transactions.

Leveraging machine learning algorithms, PayPal scrutinizes device information, session data, authentication attempts, IP addresses, and user interactions to guarantee secure and reliable transactions.

2. Enhancing Credit Scoring and Risk Evaluation with Generative AI

FinTech organizations are increasingly adopting AI to revolutionize risk management and credit scoring processes. The application of generative AI in these areas enables more precise and informed lending decisions by analyzing market trends, transaction histories, consumer spending patterns, and other pertinent data.

Generative AI significantly impacts credit evaluation by efficiently processing vast amounts of customer data, such as credit histories, purchasing behaviors, and individual incomes, using sophisticated algorithms.

Furthermore, by employing pattern recognition capabilities, generative AI aids FinTech companies in minimizing biases and providing a comprehensive assessment of a person’s creditworthiness.

Case Study: Crediture’s Adoption of Generative AI in Credit Scoring

Crediture stands out as a prominent platform in credit scoring, utilizing generative AI to refine its credit scoring and risk assessment procedures. The platform has trained its model on a wealth of financial data, enabling it to discern economic patterns, industry movements, and potential market volatilities, including bear markets and recessions.

For business lending, Crediture applies generative AI algorithms, specifically Variational Auto-Encoders (VAE), to devise personalized lending solutions. These algorithms assess the financial health of businesses to recommend bespoke credit products, thereby enhancing decision-making in lending with a high degree of accuracy and personalization.

3. Utilizing Generative AI in Algorithmic Trading

In the realm of forex trading, algorithmic trading refers to the use of automated, pre-programmed trading instructions accounting for variables such as price, timing, and volume. According to a 2019 study, a staggering 92% of all forex market transactions were executed via algorithmic trading.

Generative AI has the capability to sift through and analyze market data trends alongside current market conditions to forecast future market movements. This technology enables the automation of trading strategies for financial products, relying on thorough data analysis and the identification of algorithmic patterns for trading decisions.

Case Study: Bridgewater Associates’ Integration of AI

While many companies were still deliberating the adoption of AI, Bridgewater Associates, recognized as the world’s largest hedge fund, had already been harnessing the power of AI technologies for some time. Their extensive research and application demonstrated that AI and advanced language models are proficient in data analysis, hypothesis testing, and enhancing the decision-making process.

Greg Jason, Bridgewater Associates’ Co-Chief Information Officer, highlighted in an interview the transformative impact of utilizing generative AI and similar models. He pointed out that these technologies not only streamline operations and cut costs but also significantly enhance the precision of market forecasts, thereby redefining the landscape of financial trading through the strategic application of AI.

4. Generative AI Enhancing Customized Financial Services

A study conducted in the USA involving more than 1,000 participants revealed that 77% of Americans experience financial anxiety, and 58% believe that financial concerns dominate their lives.

Leveraging generative AI transforms the delivery of financial advice, including investment choices and financial strategy development, making these services not only more precise but also quicker. This technology is capable of evaluating spending patterns, recommending investment strategies, managing risks, and devising personalized financial plans.

For example, generative AI is adept at crafting investment portfolios that align with an individual’s goals and risk appetite, with the flexibility to adjust recommendations as circumstances change. This advancement enables financial institutions to offer highly personalized services to their clients.

Case Study: The Cleo App’s Utilization of ChatGPT Technology

Cleo acts as a virtual financial guide, employing ChatGPT technology to offer insights into budgeting and savings based on an analysis of your financial activity. By linking your bank account to Cleo, the app immediately undertakes an analysis to provide real-time financial updates and advice aimed at fostering prudent financial decisions.

Moreover, Cleo incorporates generative AI and natural language processing to respond to financial inquiries directly within the app, showcasing a practical application of these technologies in enhancing user experience with personalized financial advice.

5. Generative AI in Streamlining Regulatory Compliance and Reporting

Navigating the complex landscape of financial regulations is a paramount task for FinTech organizations, where adherence to mandatory regulatory standards is not just a requirement but a necessity for operational integrity. Generative AI emerges as a pivotal tool in ensuring compliance, significantly reducing the risk of regulatory infractions.

By analyzing extensive arrays of financial and legal texts and tracking regulatory updates in real-time, generative AI empowers financial institutions to stay ahead of compliance requirements. Utilizing these capabilities allows for the automation of compliance-related tasks, minimization of human error, adherence to critical regulations, and the avoidance of potential fines.

Case Study: FintechOS’s Contribution to Regulatory Compliance

FintechOS, a cloud-based platform, stands at the forefront of assisting financial institutions in navigating their compliance and reporting duties. With the release of FintechOS 22, the company has redoubled its commitment to facilitating digital transformation within the banking and financial sector through its innovative no-code and low-code solutions.

In addition to its technological advancements, FintechOS consistently updates its offerings to ensure alignment with evolving financial regulations. By providing tailor-made services that seamlessly adapt to regulatory shifts, FintechOS remains an essential partner for financial organizations aiming to maintain compliance efficiently.

The integration of generative AI into the FinTech sector is not merely a trend but a fundamental shift in how financial services are delivered and experienced. With its ability to drive innovation, enhance efficiency, and personalize customer experiences, generative AI is setting new standards in the financial industry.

FinTech companies are at the forefront of this transformation, demonstrating the immense potential of AI-driven solutions to revolutionize FinTech. As we embrace the possibilities offered by generative AI, the future of finance looks brighter than ever, promising a world where financial services are more inclusive, efficient, and tailored to the needs of consumers worldwide. The journey toward AI-powered financial innovation is just beginning, and the opportunities are limitless.

- Degree Pursuit: Navigating the Path to Educational Excellence - July 4, 2024

- Why Is Studying English Important in a Business Environment? - July 4, 2024

- Top 10 Data Science Skills You Need in 2024 - July 3, 2024