The Hartford Financial Services Group, often simply called “The Hartford,” is a major player in the financial services industry, established in 1810. They offer a broad range of insurance and investment products, making them a one-stop shop for many financial needs. Here’s a quick summary:

- Founded in 1810 (originally as The Hartford Fire Insurance Company)

- Headquartered in Hartford, Connecticut, USA

- Fortune 500 company with a diverse business portfolio

- Offers a wide range of property and casualty insurance, group benefits, and mutual funds

What are the selection and Interview process of Hartford Financial Services Group?

The selection process at The Hartford can vary depending on the specific role (financial advisor, underwriter, claims adjuster, data analyst, etc.), department (property & casualty insurance, life insurance, investments, etc.), and experience level required. Here’s a roadmap to navigate the potential steps involved:

1. Application: Submit your application through The Hartford’s careers website.

2. Application Review: Recruiters and hiring managers carefully screen resumes and applications to shortlist candidates whose qualifications align with the position and The Hartford’s focus on customer service, financial expertise (for relevant roles), and a commitment to ethical conduct.

3. Assessments (Possible): Some positions might involve online assessments:

- Customer Service Assessments: These might assess your understanding of financial products and services, your ability to solve customer problems, and your communication skills (especially for customer-facing roles).

- Technical Skills Assessments: These could assess your knowledge of specific insurance products, underwriting principles, or data analysis techniques (depending on the role for underwriter, data analyst roles).

4. Interviews: If your application and assessments (if applicable) impress them, prepare for one or more rounds of interviews:

- Phone Interview (Possible): An initial phone interview with a recruiter or hiring manager to discuss your background, interest in the role, and general understanding of the financial services industry (especially for non-financial roles).

- In-Person Interviews: If you progress further, you might have interviews with a panel that could include:

- Hiring Managers and Team Members from the relevant department

- Experienced Professionals in the field (e.g., senior financial advisors, underwriters)

- HR Representatives

These interviews will delve deeper into your experience, knowledge, and skills relevant to the specific position. Here are some areas they might explore:

* **Understanding of the financial services industry and current financial trends.** (especially for client-facing roles)

* **Strong customer service orientation and ability to build rapport with people.** (highly valued across various roles)

* **Financial expertise relevant to the role (e.g., knowledge of insurance products for financial advisors, underwriters).** (for relevant roles)

* **Communication and interpersonal skills.**

* **Problem-solving and analytical skills.** (especially for data analyst roles)

* **Teamwork and collaboration skills.**

* **Commitment to ethical conduct and regulatory compliance.** (highly valued at The Hartford)

5. Background Check: Upon receiving an offer, a background check is standard procedure.

Timeline: The interview process at The Hartford can take anywhere from a few weeks to several months, depending on the complexity of the role and the number of candidates involved.

Here are some additional tips for making a positive impression during your Hartford interview:

- Research the company: Learn about The Hartford’s commitment to community development, their focus on financial inclusion, and company culture, which emphasizes teamwork, a results-oriented mindset, and providing exceptional customer service.

- Tailor your resume and cover letter: Highlight the skills and experiences that are most relevant to the specific position you are applying for. Showcase your customer service skills, financial knowledge (if applicable), and your enthusiasm for the financial services industry.

- Prepare for common interview questions: Research common interview questions in the financial services industry or your specific field, and be ready to showcase your skills and knowledge. Be ready to discuss your approach to providing excellent customer service, your understanding of relevant financial products (if applicable), and how you would contribute to The Hartford’s mission of financial security.

- Practice behavioral questions: Be prepared to answer questions about your past experiences and how they demonstrate your problem-solving, teamwork, and communication skills, with a focus on customer service or financial expertise (depending on the role).

- Dress professionally and present yourself with a confident and professional demeanor.

By being well-prepared, demonstrating your qualifications, and showcasing your passion for providing valuable financial services, you can increase your chances of landing your dream job at The Hartford Financial Services Group.

How many rounds of interview conducted in Hartford Financial Services Group?

There isn’t publicly available information on the exact number of interview rounds or salary information for freshers at Hartford Financial Services Group. Their careers website doesn’t provide this detail. Here’s what you can do to get a better idea:

Number of Interview Rounds:

Based on information gathered from general job search trends and employee reviews on websites like Glassdoor and Indeed [2, 3], you can expect:

- Possible Range: Two to four rounds after an initial application.

Interview Stages (Possible):

- Initial Application: Submit your resume and cover letter online. You might also encounter a web-based assessment about your skills or suitability for the role.

- Phone Interview (possible): A recruiter might conduct a brief phone interview to discuss your experience and interest in Hartford Financial Services Group.

- In-Person Interviews (one to three rounds): These could involve discussions with:

- Hiring Manager or Team Members: They will assess your qualifications, experience, and fit for the specific role (e.g., financial analyst skills for finance positions).

- Specialists (possible for some roles): For specialized positions (e.g., underwriting, data analysis), you might meet with specialists to assess your technical skills or knowledge relevant to the role.

What is the salary for freshers in Hartford Financial Services Group?

Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “Hartford Financial Services Group” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range for similar roles (e.g., financial analyst, underwriter).

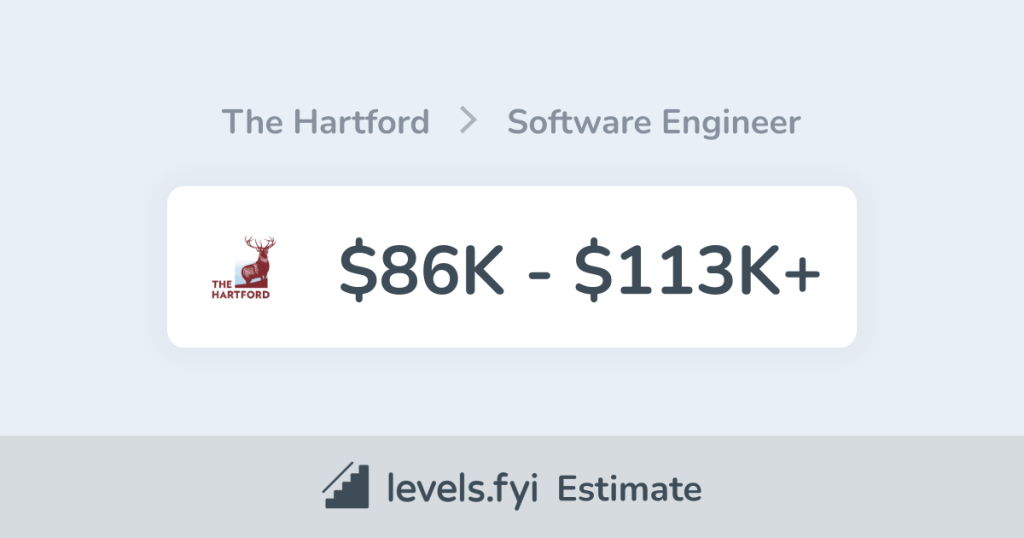

Levels.fyi: This website allows anonymous employees to share salary information. While not an official source, it can provide insights into salary ranges at Hartford Financial Services Group based on user-submitted data. Search for “Hartford Financial Services Group” and filter by “entry-level” or “freshers” positions.

Networking: If you know someone who works at Hartford Financial Services Group, try reaching out to them for insights into starting salaries for freshers in your field (e.g., finance, data analysis).

Tips:

- Research Hartford Financial Services Group: Learn about the company’s areas of focus in the financial services industry, their products and services, and their company culture. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume and interview responses to showcase skills and experiences relevant to the specific role you’re applying for. This could include technical skills (for finance or data analysis positions), coursework (relevant to your field of study), and a willingness to learn.

- Prepare for Behavioral and Technical Questions (if applicable): Be prepared to answer questions using the STAR method (Situation, Task, Action, Result) to showcase your problem-solving skills and past achievements. For technical roles, be ready for questions related to relevant financial concepts or data analysis techniques.

By following these steps, you’ll gain a better understanding of the interview process and potential salary range for freshers at Hartford Financial Services Group. Remember, your specific skills, experience, and qualifications can also influence your starting salary.

Top questions Asked for freshers in Hartford Financial Services Group

Hartford Financial Services Group offers a variety of opportunities for recent graduates (freshers) across various departments. Here are some general questions you might encounter during an interview, along with some specific examples depending on the role:

General Skills and Finance Industry Knowledge (Basic is Okay):

- Tell me about yourself and your interest in Hartford Financial Services Group. (Highlight relevant skills like communication, teamwork, problem-solving, analytical thinking (if applicable to the role), and an interest in finance or business (if applicable). Mention what interests you about Hartford’s focus on customer service, their commitment to financial inclusion, or a specific area like wealth management (if applicable)).

- Describe a situation where you demonstrated excellent customer service skills. (Focus on how you resolved a customer’s issue or went the extra mile to provide a positive experience).

- Explain a time you had to work effectively in a team on a project. (Showcase your teamwork abilities and communication skills).

- What are your strengths and weaknesses? (Be honest but highlight strengths relevant to the financial services industry or your desired role, like attention to detail, accuracy, a willingness to learn quickly, and a strong work ethic).

- Why do you want to work at Hartford Financial Services Group? (Express your interest in learning about the financial services industry, a desire to gain experience in a customer-centric environment, or an interest in Hartford’s community development initiatives. You can also mention Hartford’s company culture or their focus on innovation in financial services).

- Do you have any questions for us? (Always have thoughtful questions prepared about the role, company culture, or mentorship programs for freshers at Hartford).

Additional Questions (May Vary by Role):

- (For Sales Roles): How would you approach explaining a financial product or service to a potential customer?

- (For Customer Service Roles): Describe a situation where you had to answer a customer’s question about a bank account or loan product.

- (For Analyst Roles): How would you approach analyzing data sets related to customer behavior or financial trends (if applicable to your coursework).

Tips:

- Show your enthusiasm and willingness to learn, even if your financial services industry knowledge is basic. Hartford emphasizes providing excellent customer service and staying up-to-date on industry trends.

- Highlight your ability to work independently and as part of a team in a fast-paced environment.

- Demonstrate a problem-solving mindset and an interest in learning about finance (if applicable).

How to apply for job in Hartford Financial Services Group?

Here’s a guide on applying for a job at Hartford Financial Services Group:

- Visit the Hartford Careers Website: Head over to Hartford Careers page.

- Search for Jobs: Utilize keywords related to your field or browse job categories (e.g., Sales, Customer Service, Finance, IT, Marketing). Look for “Entry Level” or “Associate” positions that align with your skills and interests. Consider which areas of Hartford’s work (e.g., retail banking, wealth management, financial analysis) you might be interested in.

- Find the Perfect Fit: Carefully read job descriptions and identify roles that align with your qualifications and aspirations within the financial services industry. Consider your strengths and what kind of work environment you prefer (direct customer service, wealth management, financial analysis, IT support, or marketing).

- Apply Online: Submit your application electronically for the chosen position. Tailor your resume and cover letter to the specific role, highlighting relevant coursework, any prior experience (if applicable), and your eagerness to learn and contribute to Hartford’s mission of providing financial security and empowering communities.

- Prepare for Interview: If shortlisted, research Hartford Financial Services Group further, including their focus on community development, their commitment to diversity and inclusion, and their use of technology in banking. Practice answering common interview questions and prepare thoughtful questions for the interviewer about the role, company culture, and development programs for freshers at Hartford. Demonstrate your professionalism, strong work ethic, and potential to excel in a dynamic and customer-focused financial services environment.

By showcasing your relevant skills, interest in finance, and willingness to learn, you can increase your chances of landing a job at Hartford Financial Services Group.

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024

- AES: Selection and Interview process, Questions/Answers - April 15, 2024

- Amphenol: Selection and Interview process, Questions/Answers - April 15, 2024