Synchrony Financial is a leading provider of consumer financing for a wide range of retail purchases. Here’s a quick look:

- Retail Financing Giant: They partner with major retailers and brands to offer private-label credit cards, promotional financing options, and installment loans, making purchases more accessible for consumers.

- Focus on Technology and Innovation: Synchrony leverages technology to create seamless and secure financing experiences for both retailers and consumers.

- Growing Presence: Synchrony is expanding its offerings beyond traditional retail financing, including online marketplaces and consumer banking solutions.

What are the selection and Interview process of Synchrony Financial?

The selection process at Synchrony Financial can vary depending on the specific role, location, and level of experience. Here’s a roadmap to navigate what you might encounter:

1. Application: Submit your resume and cover letter through Synchrony Financial’s career portal.

2. Screening and Review: Recruiters will carefully screen applications to assess your fit for the role based on the qualifications and experience outlined in the job description.

3. Interview Stages: If shortlisted, prepare for a multi-stage interview process, including:

- Phone Interview: An initial phone conversation with an HR representative or hiring manager to discuss your background, motivations, and interest in the financial services industry, particularly retail financing.

- Video Interview(s): Synchrony may utilize video conferencing platforms for some interview stages.

- In-Person Interview(s): These interviews may involve multiple rounds with hiring managers from relevant departments (e.g., credit risk, marketing, sales, technology), and potentially senior leadership depending on the role. Here’s a glimpse into what you might encounter based on the role:

- Credit Analyst or Risk Management Roles: Expect technical discussions about your understanding of credit analysis, risk assessment models, and relevant regulations.

- Marketing or Sales Roles: Be prepared for questions about your understanding of the retail financing landscape, marketing strategies for financial products, and experience in reaching consumers or businesses.

- Technology or Data Analyst Roles: You might encounter discussions about your technical skills (e.g., programming languages, data analysis tools), problem-solving approach, and ability to work effectively with large datasets.

- General Interview Questions: Behavioral interview questions using the STAR method (Situation, Task, Action, Result) will be used to assess your relevant skills and experiences across various roles.

4. Additional Assessments: Some positions may involve online assessments to evaluate your technical skills (for IT roles), basic math skills (for sales or finance roles), or cultural fit.

5. Offer and Background Check: Successful candidates will receive a job offer contingent on a background check.

Tips for Success:

- Research Synchrony Financial thoroughly, understanding their business model (retail financing partnerships), focus on technology and innovation, and their growing presence in the financial services industry.

- Tailor your resume and cover letter to highlight relevant skills and experiences that demonstrate a strong fit for the specific role you’re applying to.

- Be prepared for technical assessments or discussions about retail financing concepts or Synchrony’s specific products (depending on the role).

- Practice your behavioral interview skills using the STAR method.

- Show your passion for financial services, analytical skills (if applicable), a strong work ethic, and an eagerness to contribute to a company shaping the future of retail financing.

By understanding Synchrony Financial’s selection process and being well-prepared, you can increase your chances of landing a position and becoming part of a team that brings financial solutions to life for retailers and consumers.

How many rounds of interview conducted in Synchrony Financial?

The number of interview rounds for freshers at Synchrony Financial can vary depending on the specific role, location, and even the time of year you’re applying [1, 2, 3]. Here’s a general idea based on information gathered from job postings, employee experiences, and career websites:

Possible Range of Interview Rounds:

- Two to four interview rounds is what most candidates report [1, 2, 3].

Here’s a possible breakdown of the interview stages:

- Initial Application: Submit your resume, cover letter, and you might encounter a written assessment (often for some roles) [2, 3].

- Phone Interview (possible): A recruiter might conduct a brief phone interview to discuss your experience and interest in Synchrony Financial [2, 3].

- In-Person Interviews (one to three rounds): These could involve discussions with [2, 3]:

- Hiring Manager or Team Members: They will assess your qualifications, experience (if any), and fit for the specific role (e.g., customer service skills, financial analysis skills for some roles).

- Senior Management (possible for some roles): For leadership or higher-level positions, you might meet with senior-level managers to assess your potential for growth within Synchrony Financial.

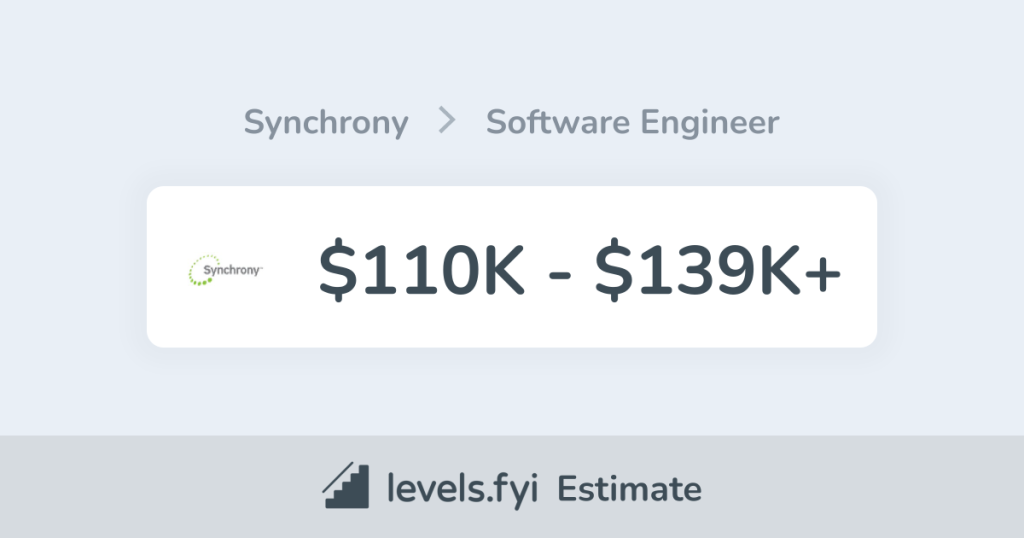

What is the salary for freshers in Synchrony Financial?

Publicly available information on exact salaries for freshers at Synchrony Financial isn’t advertised on their careers website [4]. Here are ways to get a better idea of the range for entry-level positions:

- Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “Synchrony Financial” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range for similar roles (e.g., customer service representative, financial analyst).

- Salary Negotiation: Be prepared to discuss salary during the offer stage, especially if you have relevant experience or a strong educational background in finance, business administration, or a related field. Research salary ranges beforehand and highlight your skills and willingness to learn to justify your desired compensation.

Tips for Landing a Job at Synchrony Financial:

- Research Synchrony Financial: Learn about their areas of focus in consumer financing, credit card partnerships, and digital payment solutions [4]. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume to showcase skills and experiences relevant to the specific role you’re applying for. This could include customer service skills (for customer-facing roles), analytical skills (for finance roles), communication skills, and a passion for the financial services industry.

- Prepare for Behavioral Questions: Be prepared to answer questions using the STAR method (Situation, Task, Action, Result) to showcase your problem-solving skills and achievements in previous work experiences.

By following these steps, you’ll gain a better understanding of the interview process and potential salary range for freshers at Synchrony Financial. Remember, the specific details can vary depending on the role and your qualifications. During the interview process, if there’s an opportunity to ask questions, you can inquire politely about the typical interview structure for the position you’re applying for.

Top questions Asked for freshers in Synchrony Financial

Synchrony Financial offers exciting opportunities for recent graduates (freshers) across various departments:

- Credit & Risk Management: Credit analysts, fraud analysts (finance or data analysis background preferred)

- Customer Service: Customer service representatives

- Sales & Marketing: Sales associates, marketing associates

- Operations: Operations analysts, project management associates

- Technology: Software engineers, data analysts (technical background preferred)

Here are some general questions you might encounter during an interview, along with some specific examples depending on the role:

General Skills and Financial Services Industry (Basic Understanding is Okay):

- Tell me about yourself and your interest in Synchrony Financial. (Highlight relevant skills like communication, teamwork, problem-solving abilities, analytical thinking (if applicable to the role), and an interest in finance, customer service, sales & marketing, or a specific department you’re interested in). Mention what interests you about Synchrony Financial’s focus on consumer credit, their partnerships with various retailers, or a specific product or service they offer (if applicable)).

- Describe a situation where you demonstrated excellent customer service skills. (Focus on how you went above and beyond to help a customer and resolve an issue (applicable to customer service and sales roles)).

- Explain a time you had to work effectively in a team on a project. (Showcase your teamwork abilities and communication skills).

- What are your strengths and weaknesses? (Be honest but highlight strengths relevant to Synchrony Financial or your desired role, like attention to detail, ability to learn quickly, and a strong work ethic).

- Why do you want to work at Synchrony Financial? (Express interest in learning about the financial services industry, a desire to gain experience in a growing company with a focus on customer experience, or an interest in Synchrony Financial’s specific areas of focus like credit card management or data analytics (if applicable)).

- Do you have any questions for us? (Always have thoughtful questions about the role, company culture, or mentorship programs for freshers at Synchrony Financial).

Additional Questions (May Vary by Role):

- (For Credit & Risk Management Roles): Be prepared to discuss basic financial concepts or any relevant coursework in finance or data analysis (if applicable).

- (For Customer Service Roles): Describe a situation where you had to deal with a difficult customer (if applicable to your experience).

- (For Sales & Marketing Roles): Describe a product you are passionate about and why (if applicable to your understanding of marketing).

- (For Operations Roles): Describe a situation where you demonstrated strong organizational skills and ability to follow procedures (if applicable to your experience).

- (For Technology Roles): Be prepared to discuss basic programming concepts or data analysis techniques (depending on the specific role).

Tips:

- Show your enthusiasm and willingness to learn, even if your financial services industry knowledge is basic. Synchrony Financial emphasizes customer focus, teamwork, and a strong work ethic.

- Highlight your ability to work independently, follow instructions, and be a team player in a potentially fast-paced and customer-oriented environment.

- Demonstrate a problem-solving mindset and an interest in learning about the financial services industry and Synchrony Financial’s contributions to consumer credit solutions.

How to apply for job in Synchrony Financial?

Here’s a guide on applying for a job at Synchrony Financial:

- Visit the Synchrony Financial Careers Website: Head over to Synchrony Financial Careers Website page.

- Search for Jobs: Utilize keywords related to your field or browse job categories (“Entry Level” or “Associate” positions are good options). Look for titles that align with your skills and interests (e.g., Credit Analyst, Customer Service Representative, Sales Associate, Marketing Associate, Operations Analyst, Software Engineer, Data Analyst).

- Find the Perfect Fit: Carefully read job descriptions and identify roles that align with your qualifications and aspirations. Consider your strengths and what kind of work environment you prefer (customer service floor, office setting, technical development environment).

- Apply Online: Submit your application electronically for the chosen position. Tailor your resume and cover letter to the specific role, highlighting relevant coursework, any prior experience (if applicable), and your eagerness to learn and contribute to Synchrony Financial’s success.

- Prepare for Interview: If shortlisted, research Synchrony Financial further, including their focus on building partnerships, their commitment to financial inclusion, and their use of technology to deliver innovative financial solutions. Practice answering common interview questions and prepare thoughtful questions for the interviewer about the role, company culture, and development programs for freshers at Synchrony Financial. Demonstrate your professionalism, strong work ethic, and potential to excel.

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024

- AES: Selection and Interview process, Questions/Answers - April 15, 2024

- Amphenol: Selection and Interview process, Questions/Answers - April 15, 2024