Truist Financial, a young giant formed in 2019 through the merger of BB&T and SunTrust Banks, is a leading force in North American finance. They offer a broad spectrum of banking, investment, and insurance solutions for individuals and businesses. Here’s a quick view:

- Founded: 2019 (Merger of BB&T and SunTrust)

- Headquarters: Charlotte, North Carolina, USA

- Presence: Extensive branch network across 15 states and Washington D.C.

- Services: Consumer banking, wealth management, commercial banking, and insurance.

What are the selection and Interview process of Truist Financial?

The selection process at Truist Financial can vary depending on the specific role (teller, loan officer, financial advisor, data analyst, etc.), department (retail banking, wealth management, IT, etc.), and experience level required. Here’s a general roadmap:

- Application: Submit your application through Truist Financial’s careers website.

- Application Review: Recruiters assess resumes and applications to shortlist candidates with qualifications aligned with the position and Truist’s focus on client service and financial expertise.

- Assessments (Possible): Some positions might involve online assessments:

- Financial Knowledge Assessments (loan officer, financial advisor roles)

- Technical Skills Assessments (IT, data analyst roles)

- Aptitude Tests (general problem-solving, analytical skills)

- Interviews: If you impress them, prepare for one or more rounds of interviews:

- Phone Interview: Initial discussion with a recruiter or hiring manager about your background, interest, and general financial services knowledge (especially for non-client-facing roles).

- In-Person Interviews: You might meet with a panel including:

- Hiring Managers and Team Members from the relevant department

- Experienced Professionals (senior loan officers, financial advisors, data analysts)

- HR Representatives

These interviews will delve deeper into your experience, knowledge, and skills relevant to the specific role. Here are some areas they might explore:

* Understanding of financial services and current trends.

* Strong financial knowledge (especially for loan officer and financial advisor roles).

* Technical skills relevant to the role (IT, data analysis).

* Problem-solving and analytical skills.

* Communication and interpersonal skills (highly valued at Truist).

* Sales experience and a customer-centric approach (especially for client-facing roles).

* Commitment to ethical conduct and building trust with clients (all roles).

- Background Check: Upon receiving an offer, a background check is standard procedure.

Timeline: The process can take anywhere from a few weeks to several months, depending on the role and the number of candidates.

Tips for Making a Strong Impression:

- Research Truist’s focus on financial inclusion, technological innovation, and their collaborative work culture.

- Tailor your resume and cover letter to highlight relevant skills and experiences.

- Prepare for common interview questions in the financial services industry or your specific field.

- Practice behavioral questions showcasing your problem-solving, teamwork, and communication skills, with a focus on client service.

- Follow up after the interview to thank the interviewer(s) and reiterate your interest.

How many rounds of interview conducted in Truist Financial?

The interview process at Truist Financial can vary depending on the specific role, department, and location. However, based on information gathered from employee reviews on Indeed and Glassdoor [1, 2], you can expect:

- Range: Two to four rounds is a common estimate.

Possible Interview Stages:

- Initial Application: Submit your resume and cover letter online. You might also encounter a brief online assessment about your skills or suitability for the role.

- Phone Interview (possible for some roles): A recruiter might conduct a phone interview to discuss your background and interest in Truist Financial.

- In-Person Interviews (one to three rounds): These could involve discussions with:

- Hiring Manager: They will assess your qualifications, experience, and fit for the specific role.

- Team Members (possible for some roles): You might meet with members of the team you’d be working with to assess cultural fit and communication skills.

- Specialists (possible for some roles): For specialized positions (e.g., finance, data analysis), you might meet with specialists to assess your technical skills or financial knowledge.

What is the salary for freshers in Truist Financial?

There isn’t publicly available information about exact salaries for freshers at Truist Financial on their careers website. Here are ways to get a better idea of the range:

- Salary Websites: Explore salary websites like Glassdoor or Indeed. Search for “Truist Financial” and filter by “entry-level” or “freshers” positions in your target location to get a sense of the range.

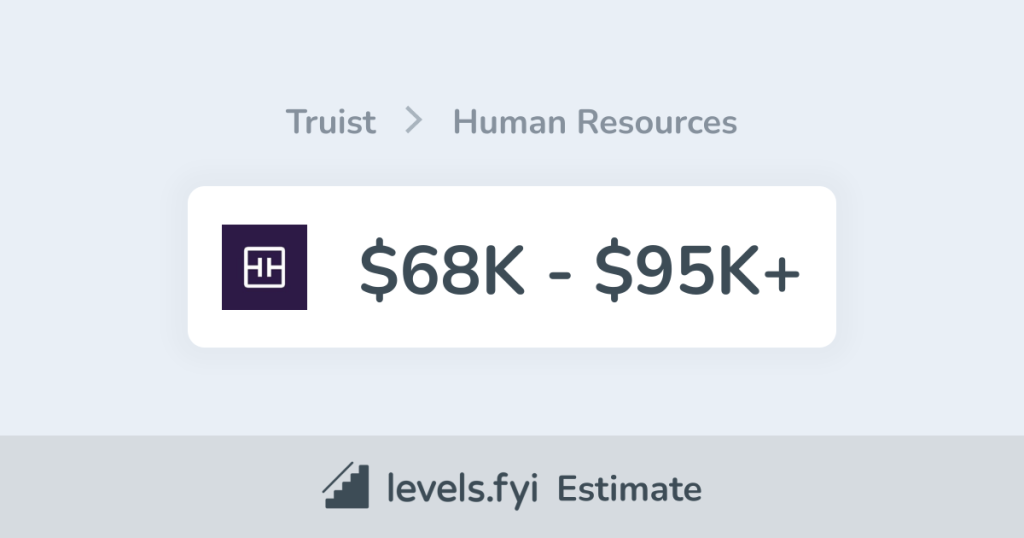

- Levels.fyi: This website allows anonymous employees to share salary information [4]. While not an official source, it can provide insights into salary ranges at Truist Financial based on user-submitted data. Search for “Truist Financial” and filter by “entry-level” or “freshers” positions.

- Networking: If you know someone who works at Truist Financial, try reaching out to them for insights into starting salaries for freshers in your field.

Tips:

- Research Truist Financial: Learn about the company’s areas of focus in banking and finance, their recent initiatives, and their company culture. This demonstrates your genuine interest during the interview.

- Highlight Relevant Skills and Experience: Tailor your resume and interview responses to showcase skills and experiences relevant to the specific role you’re applying for. This could include financial literacy (helpful but not always required), analytical skills, and customer service experience (if applicable).

- Prepare for Behavioral Questions: Be prepared to answer questions using the STAR method (Situation, Task, Action, Result) to showcase your problem-solving skills and past achievements relevant to a banking or finance environment.

By following these steps, you’ll gain a better understanding of the interview process and potential salary range for freshers at Truist Financial. Remember, your specific skills, experience, and qualifications can also influence your starting salary.

Top questions Asked for freshers in Truist Financial

Truist Financial, formed by the merger of SunTrust Banks and BB&T, offers a wide range of opportunities for recent graduates (freshers) across various departments like consumer banking, commercial banking, wealth management, and financial services. Here are some general questions you might encounter, along with some specific examples depending on the role:

General Skills and Financial Industry Knowledge (Basic is Okay):

- Tell me about yourself and your interest in Truist Financial. (Highlight relevant skills like communication, teamwork, problem-solving, a strong work ethic, and an interest in finance (if applicable). Mention what interests you about Truist’s focus on financial services, their community involvement, or a specific area like financial planning (if applicable)).

- Describe a situation where you demonstrated excellent customer service skills. (Focus on how you resolved a customer’s issue or went the extra mile to provide a positive experience).

- Explain a time you had to work effectively in a team on a project. (Showcase your teamwork abilities and communication skills).

- What are your strengths and weaknesses? (Be honest but highlight strengths relevant to the financial services industry or your desired role, like attention to detail, accuracy, a willingness to learn quickly, and a positive attitude).

- Why do you want to work at Truist Financial? (Express your interest in the financial services industry, working with people, or a desire to gain experience in a fast-paced environment. You can also mention Truist’s company culture or their commitment to financial inclusion).

- Do you have any questions for us? (Always have thoughtful questions prepared about the role, company culture, or training programs for freshers at Truist Financial).

Additional Questions (May Vary by Role):

- (For Teller Roles): How would you handle a situation where a customer has a question about a complex banking product?

- (For Customer Service Roles): How would you explain different loan options to a customer considering applying for a loan?

- (For Financial Analyst Roles): Describe a time you analyzed a large data set (if applicable to your coursework).

- (For Wealth Management Roles): How would you approach building rapport with a client and understanding their financial goals?

Tips:

- Show your enthusiasm and willingness to learn, especially if your knowledge of the financial services industry is basic. Truist emphasizes providing excellent customer service.

- Highlight your ability to work independently and as part of a team in a fast-paced environment.

- Demonstrate a positive attitude and a strong work ethic.

How to apply for job in Truist Financial?

Here’s a guide on applying for a job at Truist Financial:

- Visit the Truist Financial Careers Website: Head over to Truist Financial Careers page .

- Search for Jobs: Utilize keywords related to your field or browse job categories (e.g., Teller, Customer Service, Financial Analyst, Wealth Management, Marketing). Look for “Entry Level” or “Associate” positions that align with your skills and interests. Consider which areas of Truist’s work (e.g., retail banking, commercial banking, wealth management) you might be interested in.

- Find the Perfect Fit: Carefully read job descriptions and identify roles that align with your qualifications and aspirations within the financial services industry. Consider your strengths and what kind of work environment you prefer (branch banking, call center, financial analysis department, wealth management team, or something else entirely).

- Apply Online: Submit your application electronically for the chosen position. Tailor your resume and cover letter to the specific role, highlighting relevant coursework, any prior experience (if applicable), and your eagerness to learn and contribute to Truist Financial’s mission of serving their clients and communities.

- Prepare for Interview: If shortlisted, research Truist Financial further, including their focus on customer satisfaction, their commitment to diversity and inclusion, and their community development initiatives. Practice answering common interview questions and prepare thoughtful questions for the interviewer about the role, company culture, and mentorship or development programs for freshers at Truist Financial. Demonstrate your professionalism, strong work ethic, and potential to excel in a customer-centric environment.

By showcasing your relevant skills, interest in the financial services industry, and willingness to learn, you can increase your chances of landing a job at Truist Financial.

- PPG Industries: Selection and Interview process, Questions/Answers - April 3, 2024

- Fiserv: Selection and Interview process, Questions/Answers - April 3, 2024

- Estee Lauder: Selection and Interview process, Questions/Answers - April 3, 2024