Introduction

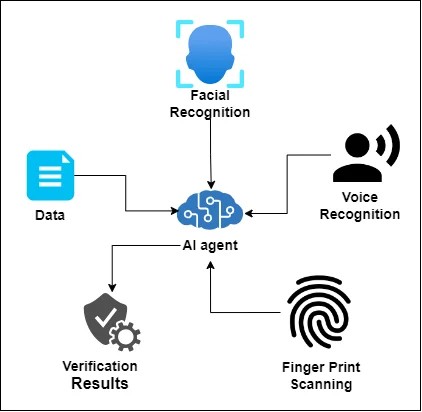

In 2026, AI identity verification tools are critical for businesses navigating the digital landscape, where fraud, data breaches, and regulatory compliance are ever-growing concerns. These tools leverage artificial intelligence, biometrics, and machine learning to authenticate identities, ensuring secure onboarding, fraud prevention, and compliance with regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering). From fintech to healthcare, e-commerce to government, AI identity verification solutions streamline processes while safeguarding sensitive data. When choosing a tool, decision-makers should prioritize accuracy, scalability, global coverage, ease of integration, and user experience. This blog explores the top 10 AI identity verification tools for 2026, detailing their features, pros, cons, and a comparison to guide your choice.

Top 10 AI Identity Verification Tools for 2026

1. Jumio

Logo/Brand: Jumio

Short Description: Jumio offers AI-powered identity verification for businesses needing fast, secure onboarding and fraud prevention, ideal for financial services, crypto, and healthcare.

Key Features:

- Biometric facial recognition with liveness detection to prevent spoofing.

- Supports over 3,500 ID document types from 200+ countries.

- Real-time verification via Jumio Go mobile app.

- AML screening and global watchlist checks.

- Seamless API and SDK integration for web and mobile.

- Machine learning trained on billions of data points for fraud detection.

- Customizable verification workflows for risk-based authentication.

Pros: - High accuracy in fraud detection, reducing false positives.

- Extensive global coverage for international businesses.

- User-friendly interface enhances customer onboarding.

Cons: - Longer verification times for edge cases.

- Pricing can be high for small businesses.

- Integration may require technical expertise for complex setups.

2. Onfido

Logo/Brand: Onfido

Short Description: Onfido provides AI-driven identity verification with a focus on scalability, serving fintech, e-commerce, and HR platforms with seamless integration.

Key Features:

- AI-powered document and biometric verification.

- Studio workflow builder for customizable verification flows.

- Supports 2,500+ document types across 195 countries.

- Liveness detection to counter deepfakes and fraud.

- AML and KYC compliance tools.

- Scalable for high-volume onboarding.

- Easy integration with mobile apps and websites.

Pros: - Fast onboarding with minimal user friction.

- Flexible workflows suit diverse business needs.

- High G2 rating (4.6★) for reliability and support.

Cons: - Occasional false positives in emerging markets.

- Advanced features may require premium plans.

- Limited fraud detection compared to competitors like Jumio.

3. Veriff

Logo/Brand: Veriff

Short Description: Veriff delivers AI-powered identity verification with robust fraud prevention, ideal for e-commerce, fintech, and regulated industries.

Key Features:

- Advanced document verification for 10,000+ ID types.

- Biometric liveness detection and facial recognition.

- Real-time fraud detection with background video analysis.

- Flexible APIs and SDKs for easy integration.

- Automated age verification for compliance.

- Global database cross-checks for sanctions and PEP lists.

- User-friendly mobile interface with multi-language support.

Pros: - High fraud detection accuracy, reducing fraud to below 1%.

- Seamless integration for rapid deployment.

- Excellent customer support, as per user reviews.

Cons: - Premium pricing may deter small businesses.

- Complex cases may require manual review.

- Limited customization for niche workflows.

4. iDenfy

Logo/Brand: iDenfy

Short Description: iDenfy is an all-in-one identity verification platform, combining AI and human oversight, perfect for fintech, crypto, and global businesses.

Key Features:

- AI-driven and human-supervised verification for accuracy.

- Supports 200+ countries and multiple ID types.

- Biometric facial recognition with liveness detection.

- AML and KYC compliance with global watchlist screening.

- Customizable dashboard for country-specific onboarding.

- Fast integration via API and SDK.

- Cost-effective pricing for startups and SMEs.

Pros: - Hybrid AI-human model ensures high accuracy.

- Affordable pricing for smaller businesses.

- Recognized as a leader in G2’s 2026 Awards.

Cons: - Limited advanced fraud detection features.

- Customer support response times can vary.

- May lack scalability for very large enterprises.

5. Trulioo

Logo/Brand: Trulioo

Short Description: Trulioo offers global identity verification with strong KYC/AML compliance, ideal for businesses with international customers in finance and e-commerce.

Key Features:

- Verifies IDs from 195+ countries.

- Biometric authentication and document verification.

- AML and sanctions list screening.

- Easy API integration for rapid deployment.

- Scalable for high-volume transactions.

- Address and phone number verification.

- Compliance with GDPR, KYC, and AML regulations.

Pros: - Extensive global reach for international businesses.

- Simple integration reduces setup time.

- Reliable for regulatory compliance.

Cons: - Limited advanced fraud detection capabilities.

- Pricing requires custom quotes, lacking transparency.

- May need local fallback solutions for rare cases.

6. Incode

Logo/Brand: Incode

Short Description: Incode provides an AI-first identity verification platform with deepfake-resistant biometrics, serving banks, healthcare, and government sectors.

Key Features:

- AI-powered biometric verification with liveness detection.

- Supports KYC/AML compliance and age verification.

- Deepfake and synthetic fraud detection.

- Reusable biometric profiles for ongoing authentication.

- Integration with government databases for high assurance.

- End-to-end fraud signal monitoring.

- Customizable SDK for branded user experiences.

Pros: - High performance in fraud prevention, especially deepfakes.

- Trusted by top U.S. banks and government agencies.

- Seamless user experience with low friction.

Cons: - Premium pricing limits accessibility for SMEs.

- Complex integration for non-technical teams.

- Limited public pricing information.

7. Ondato

Logo/Brand: Ondato

Short Description: Ondato combines AI and human oversight for flexible identity verification, ideal for fintech, banking, and crypto industries.

Key Features:

- Active and passive liveness detection for fraud prevention.

- Human-supervised checks for high-risk cases.

- Supports reusable KYC profiles for repeat customers.

- Global ID verification with KYC/AML compliance.

- Seamless API integration for web and mobile.

- Customizable verification workflows.

- Multi-layered fraud detection with AI.

Pros: - Balances security and user experience effectively.

- Strong compliance tools for regulated industries.

- High accuracy with hybrid verification model.

Cons: - Pricing can be high for high-volume users.

- Limited advanced analytics compared to competitors.

- Setup may require technical support for complex flows.

8. Auth0

Logo/Brand: Auth0

Short Description: Auth0 is a developer-friendly identity management platform with AI-powered authentication, ideal for B2C and B2B digital services.

Key Features:

- Biometric authentication and MFA support.

- API-first platform for custom integrations.

- Adaptive authentication for risk-based verification.

- Supports SSO and passwordless login.

- Scalable for businesses of all sizes.

- GDPR and HIPAA compliance.

- Real-time identity verification.

Pros: - Highly customizable for developers.

- Fast integration with robust SDKs.

- Strong G2 rating (4.5★) for ease of use.

Cons: - Advanced features locked behind enterprise tiers.

- Limited focus on document verification.

- May be overkill for simple use cases.

9. Socure

Logo/Brand: Socure

Short Description: Socure delivers AI-powered identity verification and fraud prevention, optimized for real-time onboarding in finance and e-commerce.

Key Features:

- Real-time risk scoring and fraud detection.

- Biometric verification with liveness detection.

- Supports 190+ countries with global data sources.

- No-code platform for easy setup.

- Deepfake and synthetic identity detection.

- KYC/AML compliance with watchlist screening.

- Dynamic 360-degree identity view for accuracy.

Pros: - High conversion rates with low friction.

- Strong fraud detection for complex threats.

- Scalable for global businesses.

Cons: - High costs for smaller companies.

- Integration may require technical skills.

- Customer support improvements needed.

10. AU10TIX

Logo/Brand: AU10TIX

Short Description: AU10TIX provides a multi-layered AI identity verification suite, ideal for high-fraud industries like gaming, finance, and crypto.

Key Features:

- Verifies physical and digital IDs in under 10 seconds.

- Liveness detection and face comparison.

- Multi-layered fraud detection with AI.

- Global watchlist and AML screening.

- Supports address verification via utility bills.

- Web SDK for seamless integration.

- Deepfake-resistant biometric verification.

Pros: - Fast verification speeds enhance user experience.

- High fraud prevention success rate (90%+ conversion).

- Battle-tested in high-fraud regions.

Cons: - Premium pricing may exclude smaller businesses.

- Limited transparency on pricing tiers.

- Complex setup for non-technical users.

Comparison Table

| Tool Name | Best For | Platform(s) Supported | Standout Feature | Pricing | G2/Capterra/Trustpilot Rating |

|---|---|---|---|---|---|

| Jumio | Large enterprises, financial services | Web, Mobile, API | Real-time verification via Jumio Go | Custom | 4.5★ (G2) |

| Onfido | Fintech, e-commerce, HR platforms | Web, Mobile, API | Studio workflow builder | Custom | 4.6★ (G2) |

| Veriff | E-commerce, fintech, regulated industries | Web, Mobile, API | Background video analysis | Quote-based | 4.4★ (G2) |

| iDenfy | Startups, SMEs, fintech | Web, Mobile, API | Hybrid AI-human verification | Starts at $1/verification | 4.7★ (G2) |

| Trulioo | Global businesses, KYC needs | Web, Mobile, API | 195+ country coverage | Quote-based | 4.4★ (G2) |

| Incode | Banks, healthcare, government | Web, Mobile, API | Deepfake-resistant biometrics | Quote-based | 4.5★ (G2) |

| Ondato | Fintech, banking, crypto | Web, Mobile, API | Hybrid liveness detection | Custom | 4.6★ (G2) |

| Auth0 | Developers, B2C/B2B services | Web, Mobile, API | Adaptive authentication | Starts at $23/month | 4.5★ (G2) |

| Socure | Finance, e-commerce | Web, Mobile, API | Dynamic 360-degree identity view | Quote-based | 4.4★ (G2) |

| AU10TIX | High-fraud industries (gaming, finance) | Web, Mobile, API | 10-second verification | Quote-based | 4.3★ (G2) |

Which AI Identity Verification Tool is Right for You?

Choosing the right AI identity verification tool depends on your business size, industry, budget, and specific needs. Here’s a decision-making guide:

- Small Businesses & Startups: iDenfy is a cost-effective choice with flexible pricing and easy integration, ideal for SMEs needing KYC/AML compliance without breaking the bank. Auth0 is also great for developer-focused startups requiring customizable authentication.

- Mid-Sized Businesses: Onfido and Trulioo offer scalable solutions with global coverage, perfect for growing companies in e-commerce or fintech. Their APIs ensure seamless integration with existing systems.

- Large Enterprises: Jumio, Incode, and Socure are tailored for high-volume, complex use cases in finance, healthcare, or government. Their advanced fraud detection and compliance tools meet stringent regulatory needs.

- High-Fraud Industries: AU10TIX and Veriff excel in gaming, crypto, and finance, where rapid verification and deepfake-resistant biometrics are critical.

- Regulated Industries: Ondato and Incode provide robust KYC/AML compliance and human oversight, ideal for banking and insurance.

- Budget-Conscious: iDenfy and Auth0 offer affordable plans or free tiers, while others like Jumio and Incode may require custom quotes for enterprise-grade features.

- Global Operations: Trulioo, Jumio, and Socure support extensive country coverage, making them ideal for businesses with international customers.

Evaluate your verification volume, compliance requirements, and integration needs. Testing demos or free trials is highly recommended to assess performance in your specific use case.

Conclusion

AI identity verification tools are indispensable in 2026, as businesses face rising fraud and regulatory pressures. These solutions enhance security, streamline onboarding, and build trust across industries. The landscape is evolving with advancements in biometrics, deepfake detection, and global compliance, making tools like Jumio, Onfido, and Veriff leaders in innovation. Whether you’re a startup or a global enterprise, there’s a tool tailored to your needs. Explore demos or free trials to find the best fit, and stay ahead in the ever-changing world of digital trust.

FAQs

Q1: What are AI identity verification tools?

A: AI identity verification tools use artificial intelligence, biometrics, and document checks to confirm a person’s identity, ensuring fraud prevention and compliance with KYC/AML regulations.

Q2: Are these tools secure for handling sensitive data?

A: Yes, top tools like Veriff, Jumio, and Incode use advanced encryption, GDPR compliance, and liveness detection to protect sensitive data and prevent spoofing attacks.

Q3: Can small businesses afford AI identity verification tools?

A: Tools like iDenfy and Auth0 offer affordable plans or free tiers, making them accessible for small businesses, while premium tools like Jumio may require higher budgets.

Q4: How do I choose the right tool for my business?

A: Consider your industry, verification volume, compliance needs, and budget. Test demos to evaluate user experience and integration with your systems.

Q5: What’s the future of AI identity verification in 2026?

A: Expect advancements in deepfake-resistant biometrics, decentralized identity systems using blockchain, and enhanced AI algorithms for faster, more accurate verification.

Meta Description: Discover the top 10 AI identity verification tools for 2026. Compare features, pros, cons, and pricing to find the best solution for secure onboarding and fraud prevention.

Find Trusted Cardiac Hospitals

Compare heart hospitals by city and services — all in one place.

Explore Hospitals