Introduction

Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance tools are specialized software solutions designed to help organizations verify customer identities, monitor transactions, detect suspicious activities, and comply with global financial regulations. These tools play a critical role in preventing fraud, money laundering, terrorist financing, and other financial crimes.

In today’s digital-first economy, regulatory scrutiny is increasing across industries such as banking, fintech, insurance, crypto, healthcare, and even e-commerce. Manual compliance processes are no longer scalable or reliable. KYC/AML tools automate identity verification, sanctions screening, transaction monitoring, and regulatory reporting, reducing human error and operational risk.

Real-world use cases include onboarding new customers in banks, verifying users on fintech platforms, monitoring crypto transactions, screening vendors, and ensuring regulatory audits pass smoothly.

When choosing a KYC/AML compliance tool, users should evaluate accuracy, regulatory coverage, ease of integration, scalability, security standards, reporting capabilities, and overall cost-value balance.

Best for:

KYC/AML compliance tools are ideal for banks, fintech startups, NBFCs, crypto exchanges, payment gateways, insurance firms, regulated marketplaces, compliance teams, risk officers, and enterprises handling sensitive customer data.

Not ideal for:

Very small businesses with no regulatory exposure, offline-only operations, or organizations operating in low-risk, non-regulated sectors may not need full-scale KYC/AML tools and can rely on basic identity checks instead.

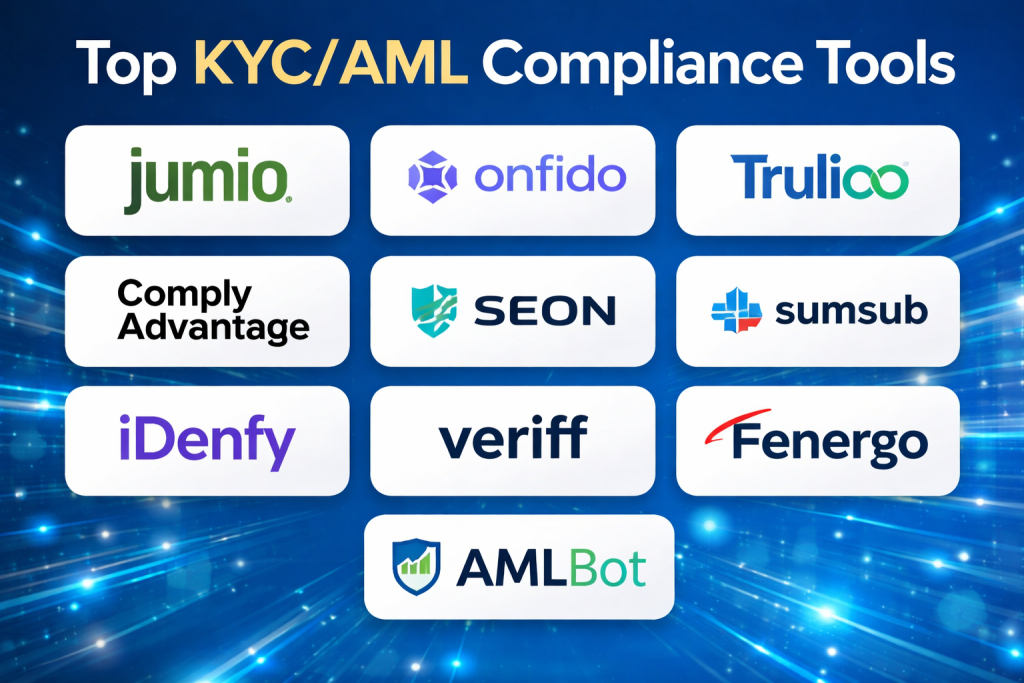

Top 10 KYC/AML Compliance Tools

1 — Jumio

Short description:

Jumio is a widely used digital identity verification platform that leverages AI and biometrics to perform fast, accurate KYC checks for global organizations.

Key features:

- AI-powered identity verification

- Biometric face matching

- Global ID document coverage

- Liveness detection

- AML and sanctions screening

- Risk-based decision engine

Pros:

- High verification accuracy

- Strong global compliance coverage

Cons:

- Premium pricing

- Complex setup for small teams

Security & compliance:

SOC 2, GDPR, ISO 27001, encryption at rest and in transit

Support & community:

Enterprise onboarding, detailed documentation, dedicated account managers

2 — Onfido

Short description:

Onfido focuses on identity verification using document checks and facial biometrics, serving fintechs, banks, and digital platforms.

Key features:

- Document verification

- Facial biometric verification

- AML screening

- Fraud signals

- Global coverage

- API-first design

Pros:

- Developer-friendly APIs

- Strong fraud detection

Cons:

- Pricing transparency issues

- Limited customization for reports

Security & compliance:

ISO 27001, GDPR, SOC 2

Support & community:

Good technical documentation, responsive enterprise support

3 — Trulioo

Short description:

Trulioo provides global identity verification and AML compliance across multiple countries and data sources.

Key features:

- Identity verification in 195+ countries

- AML watchlist screening

- Business verification

- PEP screening

- API integrations

- Data source orchestration

Pros:

- Extensive global reach

- Reliable data accuracy

Cons:

- Costly for startups

- Requires configuration expertise

Security & compliance:

ISO 27001, GDPR, SOC 2

Support & community:

Strong enterprise support, onboarding specialists

4 — ComplyAdvantage

Short description:

ComplyAdvantage specializes in AML risk detection using real-time data and machine learning.

Key features:

- Real-time AML screening

- PEP and sanctions monitoring

- Adverse media detection

- Risk scoring

- API integrations

- Continuous monitoring

Pros:

- Real-time risk updates

- Excellent data intelligence

Cons:

- Learning curve for new users

- Pricing can scale quickly

Security & compliance:

ISO 27001, GDPR

Support & community:

Knowledge base, compliance experts, enterprise SLAs

5 — SEON

Short description:

SEON is a fraud prevention and AML-focused platform offering behavioral analytics and risk scoring.

Key features:

- Device fingerprinting

- Transaction monitoring

- AML screening

- Risk scoring engine

- No-code rules

- API access

Pros:

- Easy to configure

- Good value for money

Cons:

- Limited traditional banking focus

- Less suitable for large enterprises

Security & compliance:

GDPR, encryption standards

Support & community:

Live chat support, onboarding guides

6 — Sumsub

Short description:

Sumsub offers an all-in-one KYC, KYB, and AML compliance platform for fast-growing digital businesses.

Key features:

- Identity verification

- Business verification

- AML transaction monitoring

- Video verification

- Custom workflows

- API and SDKs

Pros:

- Flexible workflows

- Strong automation features

Cons:

- UI can feel complex

- Reporting needs customization

Security & compliance:

GDPR, ISO 27001

Support & community:

Dedicated support, onboarding assistance

7 — iDenfy

Short description:

iDenfy focuses on identity verification and fraud prevention for SMBs and mid-market companies.

Key features:

- ID document verification

- Facial recognition

- AML screening

- Fraud detection tools

- SDK integrations

- Custom branding

Pros:

- Affordable pricing

- Easy integration

Cons:

- Limited enterprise-scale features

- Smaller global coverage

Security & compliance:

GDPR, ISO standards

Support & community:

Helpful onboarding, responsive customer support

8 — Veriff

Short description:

Veriff is an AI-powered identity verification platform known for fast verification and automation.

Key features:

- AI identity verification

- Fraud prevention

- AML screening

- Liveness detection

- Global document support

- API integration

Pros:

- Fast verification times

- User-friendly experience

Cons:

- Limited customization

- Premium pricing

Security & compliance:

SOC 2, GDPR, ISO 27001

Support & community:

Enterprise support, technical documentation

9 — Fenergo

Short description:

Fenergo is an enterprise-grade KYC and AML lifecycle management platform for financial institutions.

Key features:

- Client lifecycle management

- Regulatory rules engine

- AML and KYC automation

- Complex workflow orchestration

- Reporting and audit trails

- Enterprise integrations

Pros:

- Extremely powerful

- Built for complex regulations

Cons:

- High cost

- Long implementation cycles

Security & compliance:

ISO 27001, SOC 2, GDPR

Support & community:

Enterprise-grade support, consulting services

10 — AMLBot

Short description:

AMLBot focuses on crypto AML compliance, transaction monitoring, and blockchain analytics.

Key features:

- Blockchain transaction monitoring

- Wallet risk scoring

- Sanctions screening

- KYT (Know Your Transaction)

- API integrations

- Real-time alerts

Pros:

- Strong crypto specialization

- Affordable for exchanges

Cons:

- Limited non-crypto use cases

- Smaller support ecosystem

Security & compliance:

Varies / N/A

Support & community:

Email support, documentation, crypto-focused users

Comparison Table

| Tool Name | Best For | Platform(s) Supported | Standout Feature | Rating |

|---|---|---|---|---|

| Jumio | Enterprise KYC | Web, API, Mobile | Biometric verification | N/A |

| Onfido | Fintech startups | Web, API | Developer-friendly APIs | N/A |

| Trulioo | Global compliance | Web, API | Country coverage | N/A |

| ComplyAdvantage | AML intelligence | Web, API | Real-time risk data | N/A |

| SEON | Fraud prevention | Web, API | Behavioral analytics | N/A |

| Sumsub | All-in-one KYC | Web, API, SDK | Workflow automation | N/A |

| iDenfy | SMB compliance | Web, API | Affordable pricing | N/A |

| Veriff | Fast verification | Web, API | AI automation | N/A |

| Fenergo | Large banks | Web | Lifecycle management | N/A |

| AMLBot | Crypto AML | Web, API | Blockchain analytics | N/A |

Evaluation & Scoring of KYC/AML Compliance Tools

| Criteria | Weight | Description |

|---|---|---|

| Core features | 25% | Depth of KYC, AML, monitoring |

| Ease of use | 15% | UI, onboarding, learning curve |

| Integrations & ecosystem | 15% | APIs, third-party tools |

| Security & compliance | 10% | Certifications, encryption |

| Performance & reliability | 10% | Speed and uptime |

| Support & community | 10% | Documentation and help |

| Price / value | 15% | ROI and affordability |

Which KYC/AML Compliance Tool Is Right for You?

- Solo users: Lightweight, affordable tools with basic verification

- SMBs: Balance between cost, automation, and compliance coverage

- Mid-market: Scalable tools with workflow customization

- Enterprise: Full lifecycle management, deep compliance coverage

Budget-conscious teams should prioritize modular tools, while regulated enterprises should focus on compliance depth, reporting, and audit readiness. Always consider integration requirements and future scalability.

Frequently Asked Questions (FAQs)

1. What is a KYC/AML compliance tool?

It is software that automates identity verification, risk assessment, and regulatory compliance.

2. Are KYC and AML the same?

No. KYC verifies identity, while AML monitors and prevents financial crimes.

3. Do startups need KYC tools?

Yes, if they operate in regulated industries.

4. Are these tools expensive?

Costs vary widely based on features and scale.

5. Can KYC tools integrate with existing systems?

Most modern tools offer APIs and integrations.

6. How long does implementation take?

From days for basic tools to months for enterprise platforms.

7. Are KYC tools secure?

Reputable tools follow strict security and compliance standards.

8. Do these tools support global compliance?

Many offer multi-country and multi-regulation coverage.

9. What is the biggest mistake buyers make?

Choosing tools without considering scalability and integration needs.

10. Can KYC tools reduce fraud?

Yes, significantly when properly configured.

Conclusion

KYC/AML compliance tools are no longer optional for regulated businesses. They protect organizations from financial crime, regulatory penalties, and reputational damage while enabling smooth customer onboarding.

The most important factors when choosing a tool include regulatory coverage, accuracy, scalability, integration capability, and cost-value alignment. There is no single “best” KYC/AML tool for everyone. The right choice depends on your industry, company size, risk exposure, and long-term growth strategy.

By aligning tool capabilities with real business needs, organizations can ensure compliance without sacrificing customer experience or operational efficiency.

Find Trusted Cardiac Hospitals

Compare heart hospitals by city and services — all in one place.

Explore Hospitals