Pacific Life is a leading mutual insurance company with over 150 years of experience. Here’s a quick look:

- Financial Strength: They boast a strong financial reputation with consistently high ratings from major rating agencies.

- Diverse Products: Pacific Life offers a wide range of insurance and investment products, including life insurance, annuities, and mutual funds.

- Focus on Long-Term Stability: Their mutual holding company structure allows them to prioritize long-term growth and stability over short-term profits, benefiting policyholders.

What are the selection and Interview process of Pacific Life?

The selection process at Pacific Life can vary depending on the specific role (financial advisor, underwriter, claims adjuster, data analyst) and location. Here’s a roadmap for what you might encounter:

1. Application: Submit your resume and cover letter through Pacific Life’s careers website.

2. Screening and Review: Recruiters will assess applications to identify candidates with the qualifications and experience outlined in the job description. They’ll focus on skills relevant to the financial services industry and the specific role (e.g., strong financial knowledge for financial advisor roles, analytical skills for data analyst roles).

3. Interview Stages (may vary):

- Phone Interview (for some roles): An initial conversation with an HR representative or hiring manager to discuss your background, motivations, and interest in the financial services industry and Pacific Life’s focus on long-term client relationships and financial security.

- In-Person Interview(s): These may involve one or more rounds with hiring managers from the relevant department (e.g., financial services, underwriting, claims, data analytics) and potentially senior leadership depending on the role and location. Here’s what you might encounter based on the role:

- Financial Advisor Roles: Be prepared for discussions about your financial knowledge, understanding of insurance and investment products, and ability to build relationships with clients. You might encounter scenario-based questions about providing financial advice or role-playing exercises to assess your sales skills.

- Underwriter Roles: Expect discussions about your analytical skills, attention to detail, and understanding of insurance risk assessment principles. You might encounter written assessments to evaluate your financial knowledge or case studies related to underwriting scenarios.

- Claims Adjuster Roles: These roles will likely involve discussions about your problem-solving skills, empathy, and ability to communicate effectively with clients during challenging situations. You might encounter scenario-based questions about handling claims or role-playing exercises to assess your communication and negotiation skills.

- Data Analyst Roles: These positions may involve discussions about your data analysis skills, knowledge of relevant data analysis tools and techniques, and ability to translate data insights into actionable solutions for the financial services industry. You might encounter case studies or data analysis presentations depending on the specific role.

4. Additional Assessments (for some roles): Some positions may involve written assessments to evaluate financial knowledge (especially for financial advisor and underwriter roles), basic understanding of insurance products (for some client-facing roles), or data analysis skills (for data analyst roles).

5. Licensing Requirements (for some roles): Certain roles, like financial advisor and underwriter, may require obtaining specific licenses to sell insurance products or assess risk.

Tips for Success:

- Research Pacific Life thoroughly, understanding their long history, diverse financial products, and focus on client relationships. Tailor your resume and cover letter to highlight relevant skills and experiences that demonstrate a strong fit for the specific role.

- Be prepared for discussions about the financial services industry and your passion for helping people achieve their financial goals and secure their future. Highlight any relevant financial knowledge, sales experience (for client-facing roles), analytical skills (for data analyst roles), or problem-solving abilities (for claims adjuster roles).

- Practice your behavioral interview skills using the STAR method (Situation, Task, Action, Result).

- Project a positive attitude, strong work ethic, and a willingness to learn (valuable in all roles!), excellent communication and interpersonal skills (especially for client-facing roles), and a focus on detail and accuracy (important in all roles).

By understanding Pacific Life’s selection process and showcasing your qualifications and dedication to financial security, you can increase your chances of landing an interview and a rewarding career at this established financial institution.

How many rounds of interview conducted in Pacific Life?

The exact number of interview rounds at Pacific Life can vary depending on the specific position and department you’re applying for. However, based on information gathered from various sources, you can expect somewhere between 2 and 4 rounds:

Here’s a possible breakdown of the interview process:

- Round 1: Initial Screening (Phone or Video Call)

- This is often conducted by a recruiter and focuses on your background, interest in the role, and basic qualifications.

- Round 2: Phone Interview with Hiring Manager (Optional)

- In some cases, the hiring manager might conduct a separate phone call to delve deeper into your skills and experience relevant to the specific position.

- Round 3: In-Person Interview with Team (Optional)

- This could involve meeting with various team members, including the hiring manager and potential colleagues, to assess your fit for the company culture and your collaborative skills.

- Round 4: Additional Assessments (Possible)

- Depending on the role, there could be additional steps like a technical interview to assess your specific skills or a case study to evaluate your problem-solving abilities.

Factors Affecting Rounds:

- Seniority of the position: Senior positions or those requiring specialized skills might have an additional round, such as a technical assessment.

- Department Needs: The specific department you are applying to might have its own process with additional steps.

Tips to Find Out More About Interview Rounds:

- Job Postings: Review the job description on Pacific Life’s careers website or job boards. They might mention the typical interview stages involved for the specific role you’re interested in.

- Contact with Recruiter: If you have a phone screening with a recruiter, ask about the number of interview rounds for the position you’re applying for.

- Online Resources: Look for interview experiences shared by candidates on platforms like Glassdoor or Indeed. While not guaranteed to reflect the current process, these can provide insights into the typical number of rounds for different positions at Pacific Life.

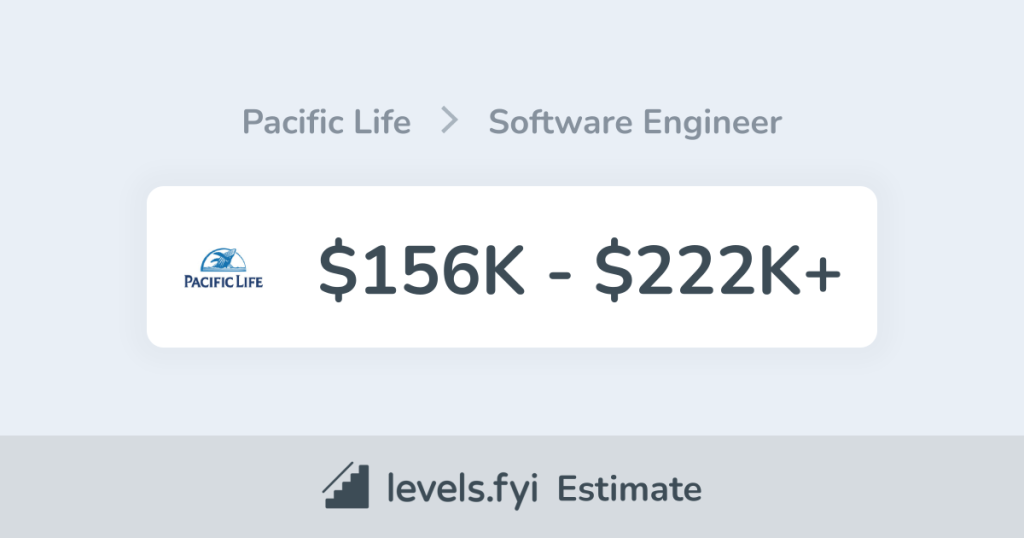

What is the salary for freshers in Pacific Life?

Determining the exact salary for freshers at Pacific Life can be tricky, but here are some resources that can help you estimate the range:

Salary Websites:

- Levels.fyi: This website allows users to report their salaries. Search for “Pacific Life” and filter by “Entry Level” or “New Grad” to see what others have reported (keep in mind this data may not be verified by the company).

- Salary Comparison Websites: Websites like Glassdoor or Indeed might have salary information for entry-level positions at Pacific Life, though it may not be specific to freshers with no experience glassdoor.com, indeed.com.

Pacific Life Resources:

- Job Postings: Check the descriptions for entry-level positions you’re interested in on Pacific Life’s careers website. Sometimes, they might mention salary ranges.

Tips:

- Contact Pacific Life HR: The HR department at Pacific Life might be able to provide more specific information about freshers’ salaries for the role you’re interested in.

- Industry Averages: Research salaries for entry-level positions in the insurance industry. This can give you a general idea of what freshers might expect at Pacific Life.

- Location Matters: Remember, salaries can vary significantly depending on the location and cost of living. Research typical salaries for entry-level positions in your desired field within your target city or region.

By combining information from these resources and conducting further research, you can develop a more informed estimate of the salary range for freshers in your target role at Pacific Life. Remember, the actual offer can vary depending on factors like your specific skills, experience level, and the location of the position.

Top questions Asked for freshers in Pacific Life

Pacific Life doesn’t publish a definitive list of top interview questions for freshers, but here’s a breakdown of what you might encounter during an interview, along with tips for finding more specific questions and how to apply:

General Interview Questions for Freshers:

- Tell me about yourself and your career goals in the insurance industry (or a related field like finance, business, or data analysis). (Tailor your answer to show interest in Pacific Life’s financial strength and their focus on helping people achieve financial security)

- Why are you interested in Pacific Life specifically? (Research their commitment to their policyholders, innovation in the insurance industry, and fostering a positive work environment)

- What are your strengths and weaknesses? (Be honest but focus on framing weaknesses as areas for development)

- Describe a time you demonstrated excellent teamwork or problem-solving skills. (Highlight relevant skills)

- Do you have any questions for us? (Prepare insightful questions to show your interest and initiative)

Possible Role-Specific Questions (Depending on the Position):

- Sales Associate Associate: Be prepared for questions about your communication skills, ability to build relationships with potential clients, and understanding of the financial services industry (basic level is okay for freshers). You might also be asked about your sales goals and strategies (demonstrate you’ve researched the industry).

- Customer Service Associate Associate: These roles might involve questions about your communication skills, ability to handle customer inquiries patiently and efficiently, and understanding of basic insurance products and services.

- Data Analyst Associate: These roles could involve questions about your analytical abilities, proficiency in data analysis tools (like Excel is a plus), and eagerness to learn new technologies.

Finding More Specific Questions:

- Pacific Life Careers Website: Explore the careers section of Pacific Life’s website, particularly under “FAQs” or “Interview Tips.” They might have resources for new hires in your desired field.

- Pacific Life Interview Reviews: Look for interview reviews on websites like Glassdoor to get insights from past interviewees, keeping in mind that experiences may vary.

- Informational Interviews: Consider reaching out to Pacific Life employees on LinkedIn for informational interviews (brief conversations to learn more about the company and specific roles).

How to apply for job in Pacific Life?

1. Search for Open Positions:

- Head to Pacific Life’s careers website: Pacific Life’s careers page.

2. Target Your Search:

- Utilize filters to find “Entry Level” or “Associate” positions that align with your skills and interests. You can also filter by Location, Department (e.g., Sales, Customer Service, Data Analysis), or Keyword (e.g., sales associate associate, customer service associate associate, data analyst associate).

3. Apply Online:

- Once you discover a relevant opportunity, click “Apply Now” and follow the instructions. You’ll likely need to submit:

- Resume: Tailor your resume to highlight relevant coursework, projects, or internship experiences (if applicable) in finance, business, data analysis, or a related field. Focus on transferable skills like communication, problem-solving, analytical skills (develop foundational knowledge for data analyst roles), a willingness to learn quickly, and a strong work ethic. Quantify your achievements whenever possible (e.g., improved customer satisfaction by X%).

- Cover Letter (Optional, but Recommended): Craft a compelling cover letter that showcases your genuine interest in Pacific Life and the specific role. Tailor it to the position and highlight why you’re a strong fit (mention transferable skills if experience is limited). Express your interest in the insurance industry and Pacific Life’s mission of financial security.

4. Tips:

- Highlight Transferable Skills: Even without direct experience in insurance, focus on transferable skills like communication, problem-solving, analytical skills (develop foundational knowledge), a willingness to learn quickly, and a strong work ethic.

- Research Pacific Life’s Products and Services: Gain a basic understanding of the types of insurance products and services Pacific Life offers.

- Mutual of Omaha: Selection and Interview process, Questions/Answers - April 15, 2024

- AES: Selection and Interview process, Questions/Answers - April 15, 2024

- Amphenol: Selection and Interview process, Questions/Answers - April 15, 2024